Mar 29, 2020

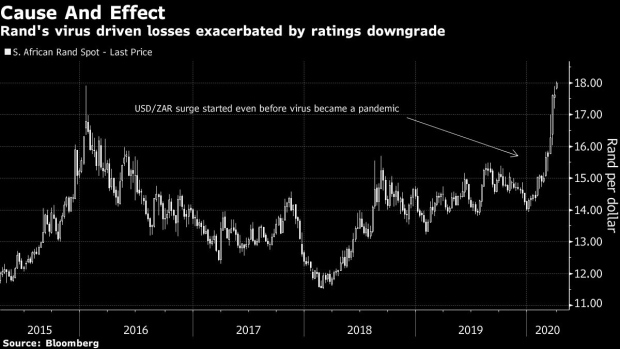

Rand Leads Currency Declines as Downgrades Ripple Across Markets

, Bloomberg News

(Bloomberg) -- South Africa’s rand led declines in major currencies against the dollar on Monday as credit rating downgrades continued to ripple through markets.

The rand fell more than 2% versus the greenback to a record low of 18.0863 while Mexico’s peso came under renewed pressure, dropping as much as 1.6% in early Asia trading.

The pound also felt the pinch of a downgrade after Britain had its credit ranking cut by Fitch Ratings, which cited the weakening of public finances caused by the impact of the Covid-19 outbreak. Sterling fell as much as 0.7% in response to the after-market downgrade on Friday. Before that it had closed the week up 7.2% against the greenback.

After the New York close on Friday, Moody’s Investors Service cut South Africa’s long-term foreign-currency and local-currency issuer ratings to Ba1 from Baa3, with the outlook to remain negative. Moody’s cited the continuing deterioration in fiscal strength and “structurally very weak growth.”

Mexico’s peso was still reeling from the effects of a cut to its sovereign credit rating last week by S&P Global Ratings. The nation’s long-term foreign currency debt rating was downgraded by S&P to BBB, the second-lowest investment grade score, from BBB+. The peso fell 1.5% against the dollar to 23.6998 as at 8:02 a.m. in Tokyo.

©2020 Bloomberg L.P.