Aug 25, 2022

RBNZ’s Orr Signals Aggressive Tightening Cycle May Be Near End

, Bloomberg News

(Bloomberg) -- New Zealand may be nearing the end of its aggressive tightening cycle with Reserve Bank Governor Adrian Orr pointing to emerging signs that consumption is beginning to cool.

“We know we have to slow the economy,” Orr told Bloomberg Television in an interview from Jackson Hole where he’s attending an annual central bankers meeting. “We knew we had to be 3% plus to begin that slowing journey and now we’re in a much more comfortable position.”

“We think there’ll be least another couple of rate hikes, but then we hope to be in a position where we can be data driven.” The governor’s comments pushed the kiwi dollar a touch lower.

The RBNZ last week raised its Official Cash Rate to 3% and projected the benchmark would need to get to at least 4% to quell the fastest inflation in more than three decades.

The central bank’s 2.75 percentage points of hikes in the past 10 months is its fastest pace of tightening since pioneering inflation targeting more than 30 years ago and exceeds both the Federal Reserve and the Bank of Canada.

Most economists expect New Zealand’s tightening cycle will end in early 2023 with the OCR at 4%, though some say there’s only scope for one more half percentage-point hike before the pace slows.

“The annual rate on inflation is likely to drop substantially in the next reading, setting up the RBNZ to pay more heed to the activity data and conclude the hiking cycle over the next couple of meetings,” said Ben Jarman, a senior economist at JPMorgan Chase & Co.

A focus on activity turned sharper Thursday after New Zealand reported an unexpected decline in second-quarter retail sales. That raised the risk of consecutive quarters of economic contraction, the local definition of recession.

No Recession

“Our core view is no, that we won’t see technical recession,” Orr said. “There’s quite a reasonable bounce back in economic activity.”

Still, the governor made clear the RBNZ wants to see lower consumption.

“Our outlook is for almost flat real consumption so for us to see retail sales come off like that, it’s not a surprise,” Orr said. “It’s a good signal that that monetary policy is biting and we’re doing our work.”

“Consumers will be taking a significant part of the brunt of the slowdown because, we’re an open trading economy. Our monetary policy mostly bites on domestic spending.”

While the RBNZ doesn’t project a recession in 2023, the bank forecasts sharply slower economic growth as it seeks to constrain demand and bring it back in balance with supply.

“Slower growth is a necessary position,” Orr said. “It doesn’t have to be negative growth.”

The governor said policy makers are watching for evidence that price pressures are receding. A report this month showed two-year ahead inflation expectations fell for the first time since 2020.

The RBNZ forecasts consumer price inflation will ease to 3.8% by the end of 2023 from a peak of 7.3% in the second quarter of this year.

“We’re watching for signs where we can be confident we are slowing the economy, and confident that that is credible and feeding into inflation expectations,” Orr said. “We’re seeing the beginning of that quite strongly. I do feel confident we’re on top of it.”

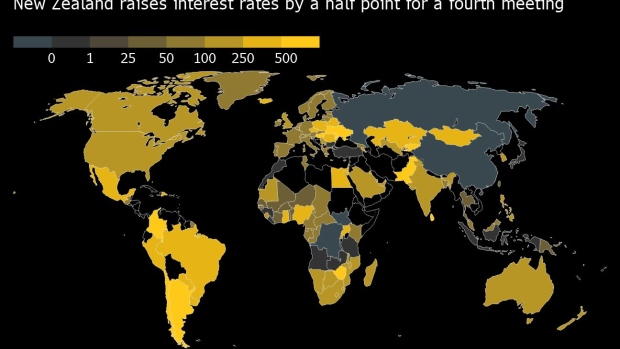

Central bankers around the world are rapidly raising rates to try to slow demand and rein in price pressures. But that also opens up the possibility of going too hard and tipping their economies into recession.

“Pushing that hard is going to take most countries around the world very close to zero economic growth, or certainly below potential economic growth, otherwise they’re not doing their job,” Orr said. “It’s likely that some countries will be printing two negative quarters of growth.”

(Updates with more from Orr, comment from economist.)

©2022 Bloomberg L.P.