Mar 26, 2024

Retail Investors Throw a Meme Stock Party In Face of High Rates

, Bloomberg News

(Bloomberg) -- The retail investing crowd is back in the throes of a meme stock mania as encouraging messaging from the Federal Reserve, GameStop Corp.’s expected earnings and sky-high stock prices ignite a euphoria among day traders.

Individual investors’ piece of options volume has ticked higher as traders buy calls to position for continued rallies in already frothy equity indexes. They snapped up shares of Reddit Inc. after its scorching initial public offering last week while also pumping up old classics, sparking a 15% surge in GameStop shares on Monday and rocketing Bitcoin toward fresh highs.

“A proper comparison would be the summer of 2021,” said Vincent Deluard, StoneX’s director of global macro strategy. “With last week’s extremely dovish Fed meeting, we had the all-clear signal, and that was the cherry on top.”

Institutional traders aren’t exactly on pause with the S&P 500 Index hitting 20 new highs in less than three months this year. But demand for put options ticked up modestly from a month ago as technical strategists grow increasingly skeptical of further gains in stocks. To many Wall Street prognosticators, valuations this stretched signal a correction is coming. But to many retail traders, they mean it’s time to go all-in.

Last week, the S&P 500 rallied 2.3% — its largest one-week advance in three months — after the Fed signaled three rate cuts are coming this year. This week it’s the shares of Wall Street Bets’ darlings that have soared while the S&P has been more subdued.

On Monday, two social media platforms — Reddit Inc. and Trump Media & Technology Group — jumped roughly 30% alongside GameStop’s bounce. Options activity in all three was led by small lots, a sign of individual investors’ involvement.

The largest number of Gamestop options contracts traded since the start of the year on Tuesday, as investors readied for the firm’s earnings report after the market closed. But the stock slumped some 18% in late trading with the print showing GameStop missed estimates for sales and adjusted earnings per share.

Also on Monday, Trump Media — then referenced by the name of the blank check firm, Digital World Acquisition Corp. — saw its second highest number of options traded for the year, topped only by Friday’s activity. Reddit’s options, which launched Monday, attracted some 90,000 contracts, with calls outnumbering puts. Just three hours into Tuesday’s session, total volume had already topped that level.

Options “are an easy way for them to speculate,” said Bret Kenwell, a US options investment analyst at eToro Group Ltd, noting retail trader activity in the past few sessions. “Worst case they lose their premium. Best case, they have multifold returns.”

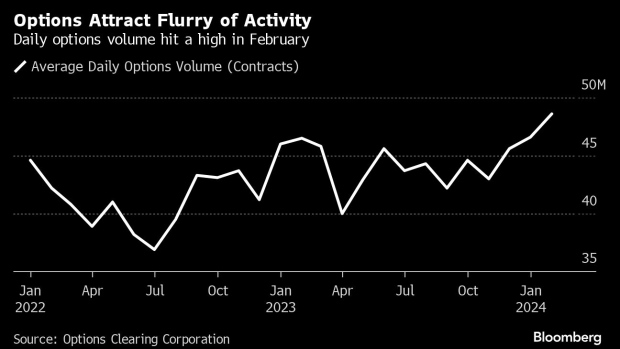

The action at the start of the week dovetails trends seen all year — a warning to Fed Chair Jerome Powell that higher-for-longer-rates haven’t tamed speculative buying. Retail’s share of total options volume hit an all-time high earlier this year and has dropped off only slightly in recent weeks, according to data from JPMorgan Chase & Co. The excitement helped push average daily options volume in February to its highest on-record, according to data from the Options Clearing Corporation.

Similar stories have unfolded in the digital asset space, with Bitcoin up some 65% since the start of the year. Crypto-exposed shares, including Robinhood Markets, Inc. and Coinbase Global Inc., have jumped as well.

“There’s that meme element to it, that almost harkens back to AMC and Gamestop in 2020 and 2021,” Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets, told Bloomberg TV.

Meanwhile, institutional traders have shown slight signs of added caution. While demand for downside hedges dropped off somewhat this week, the price of put options crept up modestly at the start of March as the Cboe Volatility Index — or VIX — popped up from its lows near the end of last year. Overall, however, sentiment remains remarkably bullish.

But even amid the broad market euphoria, the hype from the Wall Street Bets crowd stand outs. For now, retail traders seem content to be relishing in a “party-on environment,” said Brent Kochuba, founder of options platform SpotGamma.

“It’s like musical chairs,” he said. “Unless the music stops, it just keeps going.”

--With assistance from Rita Nazareth.

(Updates headline, along with GameStop earnings in seventh paragraph.)

©2024 Bloomberg L.P.