Mar 23, 2024

Retailers Turn to ‘Extreme Bargains’ to Lure Shoppers as Consumer Spending Underwhelms

, Bloomberg News

(Bloomberg) -- On many weekends, dozens of people line up in a nondescript alleyway in east London to shop at sample sales: designer clothing offered at discounts that typically stretch to 70% or more.

A few weeks back, while consumers were seeking bargains at a sale by luxury retailer Matches, solicitors were starting a form of insolvency proceedings for the brand. It came just months after the business had been acquired by Mike Ashley’s retail empire.

Matches’ woes are the latest sign that retailers’ trouble is spreading across the Atlantic amid weaker consumer spending. Shops have been pushed to the breaking point after inflation has boosted their expenses and weighed on consumer spending, and even heavy discounting isn’t enough to save them. Their difficulty comes after bumps that have included pandemic closures and supply chain snarls.

“Even the strongest and highest profile brands up and down the country are struggling,” said Julie Palmer, a partner at consulting firm Begbies Traynor Group Plc, referring to the UK. She cited a “difficult macroeconomic environment, reduced discretionary consumer spending, higher interest rates and renewed supply chain challenges.”

The industry is still reeling from a disappointing Christmas season — the most critical period of the year for shops. Total sales in the UK grew a mere 1.7% in December, compared with about 7% a year earlier, according to a report by the British Retail Consortium and consultancy KPMG.

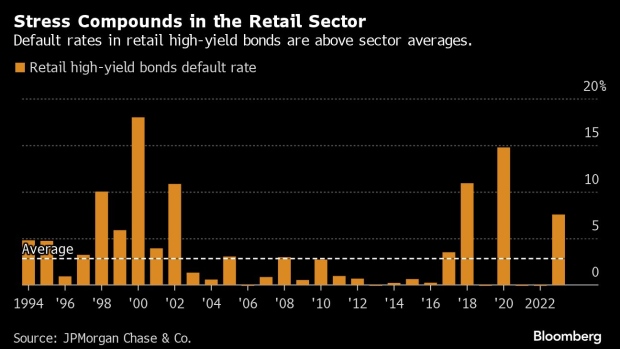

It’s a similar situation in the US, where consumer spending started the year weaker than expected, while inflation was higher than forecast, helping explain the shopping pullback. That contributed to defaults in the retail sector of the US high-yield bond market soaring past 5.4% in the last 12 months, nearly double the 22-year average of 2.8%, according to a March 1 report by JPMorgan Chase & Co.

Another common thread among the companies struggling today is their relatively narrow focus, said Melissa Minkow, director of retail strategy at digital consultancy CI&T.

“So much of this is specialty retail, and if you’re going to sit in a niche space, you have to do that better than anyone to both survive and thrive,” Minkow said.

In the past several months, retailers Express Inc., Big Lots Inc., 99 Cents Only and more have all sought rescue financing or to restructure debt as sales lagged runaway expenses. Joann Inc. filed for bankruptcy protection earlier this week even after a pandemic boom in crafting lifted sales.

“Consumers’ budgets are strained,” said Scott Friedman, chief credit officer at credit-rating and consulting firm Pulse Ratings. Distress at budget chains is partly because the discounters’ core customers — low-income households — are cherry-picking what they purchase to save as much money as possible, he said.

“They are avoiding the discretionary items and only buying what they need — which carries a lower margin for the retailers,” Friedman added. Big Lots’ Chief Executive Officer Bruce Thorn plans to focus more on “extreme bargains” to attract shoppers and stem losses.

At the other end of the market, Matches, which sells everything from a £490 ($616) Burberry polo shirt to a £1,025 Loewe blanket, is returning to the Hackney warehouse early next month with another discount sale. Fashion chain Ted Baker applied to start insolvency proceedings on Tuesday even as UK retail sales came in stronger than expected in January.

“There is a market if you are a well-run, well-capitalized business which can give your customers what they want,” said Begbies Traynor’s Palmer. “Otherwise, there just isn’t enough appetite for all these retailers to exist.”

Week in Review

- Investment manager Barings sued Corinthia Global Management and former employees Ian Fowler and Kelsey Tucker after the upstart private credit firm poached more than 20 employees in one of the largest team lifts at an alternative asset manager in recent years.

- The Federal Reserve held interest rates steady Wednesday and is maintaining a forecast that includes three-rate cuts this year, a welcome relief to investors betting that the central bank has finished its tightening cycle.

- Another Chinese developer defaulted. Radiance Holdings Group Co. defaulted on a $300 million bond after it missed a payment due Wednesday. The move surprised investors who bet on a timely repayment over the past few days. The builder cited extreme pressure in China’s property sector and lack of improvement in sales as a major reason.

- Meanwhile, units of cash-strained China Vanke Co. secured a 14-year loan from Industrial Bank Co. to refinance debt, gaining some breathing room as it has been trying to stave off its first-ever default.

- An obscure investment product used to finance risky real estate projects is facing unprecedented stress as borrowers struggle to repay loans tied to commercial property ventures.

- Money managers and analysts in US debt markets are concerned about risky US companies increasingly borrowing solely in the loan market. Investors that fund these companies often get first dibs if the borrower goes broke, known as having a first lien, and more corporations have little in the way of second-lien debt or other borrowings further back in line to be repaid.

On the Move

- Private credit lender Monroe Capital hired Waleed Noor as managing director and head of Middle East distribution.

- Private credit giant Ares Management Corp. named Matthew Theodorakis joint head of the European direct lending leadership team, promoting him to one of the company’s top positions in Europe.

- Jefferies Financial Group Inc. has hired Energy Capital Partners’ Lincoln Singleton as a managing director within its private fund group.

- Frances Pak, who worked in the public finance group for JPMorgan Chase & Co., has left the firm and is joining Jefferies Financial Group later this spring, according to people familiar with the matter.

- Truist Financial Corp. hired Markus Wirtz from Bank of America Corp. to advise on asset-management dealmaking, according to a person with knowledge of the matter.

--With assistance from Rheaa Rao.

©2024 Bloomberg L.P.