Dec 18, 2017

Richard Croft's Top Picks: December 18, 2017

BNN Bloomberg

Richard Croft, president and chief investment officer at R.N. Croft Financial Group

FOCUS: Options and ETFs

_______________________________________________________________

MARKET OUTLOOK

MACRO ISSUES

1. U.S. interest rates

Look for two and possibly three rate hikes in 2018. Much will depend on whether we see wage inflation, which has so far been muted. The lack of consumer inflation is partly due to the Amazon effect, which has disrupted U.S. retailers. Amazon has been willing to squeeze margins to gain market share which has benefited consumers at the expense of margins. The lack of wage inflation is harder to explain. There has been a reluctance among global companies to increase wages which anecdotally may be fallout from government programs that have pushed up minimum wages in various regions.

2. Impact on the yield curve

Lack of inflation is one reason for a flattening of the yield curve. Despite rates at the short end being pushed higher, it has not had a meaningful impact on medium- and long-term rates. The spreads between medium/long and short rates have narrowed. Another reason for tighter spreads is demand from international investors for medium- and longer-term treasuries. While the yield is not appealing to North America institutions, it is good for international institutions when compared to similar term structure rates in Europe and Japan. Add in a stronger U.S. dollar, which is likely given the proposed tax plan, de-regulation and a pick up in GDP, and U.S. Treasury yields look attractive.

3. U.S. unemployment rate

The U.S. has the lowest unemployment rate since 2001. At 4.1 per cent unemployment, that is ostensibly full employment accounting for the transitory effects of people moving from one job to another. At some point I think worker shortages will lead to wage inflation, which could stimulate GDP in 2018. If nothing else, it would be a major step towards normalizing the economy. The challenge is if inflation hits too fast before the Fed can react.

4. U.S. tax plan

The major beneficiaries from the U.S. tax bill will be corporations. The lowering of the corporate tax rate should be a once in a lifetime opportunity to buy into profitable smaller companies in the Russell 2000 index. Not sure tax reform will lead to P/E expansion as some of that has already been priced in, but it should push equity values higher. The one-time incentive to repatriate foreign capital has merit, but I’m not sure it will have the intended effect on the economy. While some of that capital will find its way into new projects and job creation, much will go back to shareholders in the form of increased dividends or stock buybacks.

SECTOR ISSUES

Energy: Oil prices will likely remain in the mid-50s range. This has more to do with the anticipated sale of Saudi Aramco shares in 2018.

Retail: Bricks and mortar retail will continue to suffer under the Amazon effect. I suspect we will see some major shakeouts in this space during 2018. This could negatively impact real estate investment trusts that invest in retail space (i.e. RioCan REIT).

Technology: The next big wave will be artificial intelligence which is what will power driverless cars and, in our industry, trading algorithms.

Financials: Money-centre banks should continue to do well in 2018 based on three main drivers: 1) regulatory reform, 2) changes in the corporate tax rate and 3) higher interest rates if the short-term rates manifest into higher mid- and long-term rates. The key to point 3 will be the spread between two and ten-year rates.

TOP PICKS

iShares Russell 2000 Index ETF (IWM.US) - Buy calls on Russell 2000 Index (recent price US $152.22). Buy IWM March (2018) 150 calls at US $6.00.

Speculative play on U.S. tax reform. Maximum potential is unlimited but you could lose your entire investment of US $6.00 if IWM closes below the 150 strike in March 2018.

Roku (ROKU.FRA) - Recent price US $52.31 cash secured put. Sell ROKU April 35 puts at US $3.80.

Extremely high option premiums (implied volatility 103%) reflecting the speculative backdrop for this stock. Roku, Inc. primarily operates a TV streaming platform that allows users to access a range of movies and TV episodes, as well as live sports, music, news, and others. In that sense it competes against Netflix. As of June 30, 2017, the company had approximately 13.3 million subscribers. It also provides streaming media players and accessories under Roku brand to access its TV streaming platform, as well as sells branded channels on remote controls.

Financial Select Sector SPDR Fund (XLF.US) - Buy XLF Financial Select Sector SPDR at US $27.81.

The XLF is a U.S. ETF that should benefit from de-regulation and higher interest rates. Low MER and exposure to regional banks that should also benefit from the new corporate tax structure. There may be a pullback in early January but after that the XLF should move higher.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| IWM | N | N | N |

| ROKU | Y | Y | Y |

| XLF | N | N | N |

PAST PICKS: MAY 4, 2017

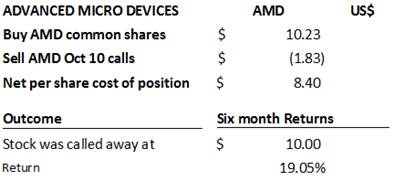

Advanced Micro Devices (AMD.O) - Covered call (sale of Oct 10 calls).

Stock was called away in October, investor would have earned the maximum return 16.28% over six months

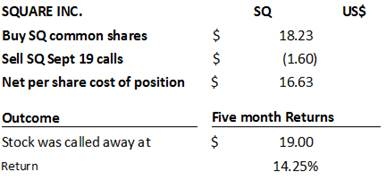

Square Inc (SQ.N) - Covered call (sale of Sept 21 calls).

Stock was called away in September, investor would have earned the maximum return 11.70% over five months

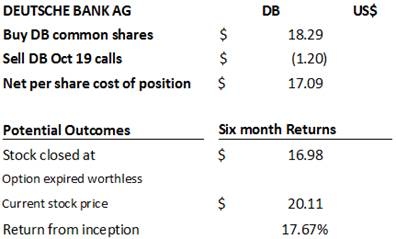

Deutsche Bank (DB.N) - Covered call (sale of Oct 19 calls).

Stock was trading below the strike price at the October expiration. Option would have expired worthless. DB closed Friday at US $19.43. The total return on the initial investment including the expiration of the October 19 calls is 12.8%.

TOTAL RETURN AVERAGE: 17%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| AMD | N | N | Y |

| SQ | Y | Y | Y |

| DB | N | N | N |

WEBSITE: www.croftgroup.com