Mar 22, 2023

Russia Says Gold Stash Grew During War, Lifting Veil on Reserves

, Bloomberg News

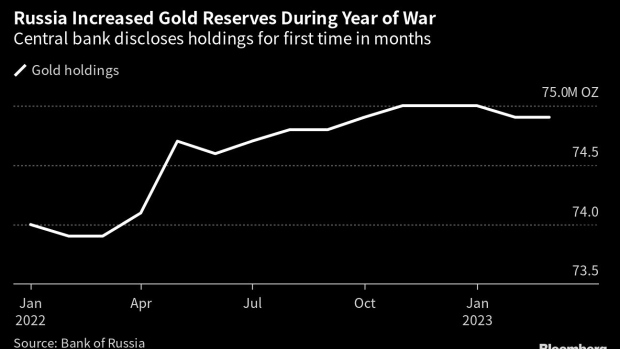

(Bloomberg) -- Russia’s central bank said its bullion holdings jumped by 1 million ounces over the past year as it bought gold in the face of Western sanctions.

The Bank of Russia said it held 74.9 million ounces of gold at the end of February, unchanged from the previous month but up from 73.9 million a year earlier. That bullion hoard was worth $135.6 billion, it said.

The increase in bullion reserves equates to about a tenth of the gold output of Russia, the world’s No. 2 producer. The central bank was once the biggest sovereign buyer of gold, scooping up almost all of the country’s mined output before pausing purchases in early 2020. Shortly after Russia invaded Ukraine, the central bank resumed purchases but this is the first indication of how much it bought.

Russia’s gold has been shut out of western markets since import bans were put in place by G-7 nations and the European Union last year. Local producers, who previously shipped most of their metal to London, were forced to find new customers in Asia.

Over the 12 months through February, the Bank of Russia’s total holdings of foreign exchange and gold dropped to $574 billion from $617 billion. US sanctions imposed on Russia’s foreign exchange reserves have given some institutions a reason to seek alternatives to the dollar.

Russia is gradually resuming the release of economic indicators after halting their publication last year.

Central banks more broadly bought a record 1,136 tons (about 37 million ounces) of gold last year, according to data from the World Gold Council.

Another big buyer was China, which begun to disclose gold purchases in December after years of silence. The People’s Bank of China has added about 102 tons to its gold pile in the four months through February, according to data on its website.

(Updates with details on other central banks from seventh paragraph)

©2023 Bloomberg L.P.