Aug 5, 2022

Singapore Braves Tough Market With Debut 50-Year Green Bond

, Bloomberg News

(Bloomberg) -- Singapore defied some of the toughest market conditions in years to issue a maiden 50-year green bond, tapping into resilient demand for environmentally friendly notes to aid its push to become a regional hub for such debt.

The city state raised S$2.4 billion ($1.7 billion) via the sovereign offering Thursday, some S$900 million more than its minimum target. The deal, whose proceeds will be used to finance public transport, attracted more than S$5.3 billion of orders.

The landmark bond sale via syndicate took place at a time when global debt markets had been roiled by aggressive monetary tightening by major central banks, leading to a drop in new issuance. However, sales of green notes have dropped less, testament to investors’ continued enthusiasm about the new category of finance targeting climate woes.

The inaugural 50-year deal also helps Singapore’s bond market enter a new chapter, offering local firms a fresh benchmark to price longer-dated debt.

While the flood of sustainability-oriented debt issuance globally has prompted critics to warn that some of it may not actually be used for the intended purposes, there is little doubt about Singapore’s latest offering.

“Clean transportation falls under one of the green categories of” Singapore’s environmental bond principles, which are aligned with an international standard, said Jia Jingwei, an analyst at Fitch Ratings.

Singapore’s debut green issuance is part of the government’s plan to raise as much as S$35 billion of environment-focused financing by 2030.

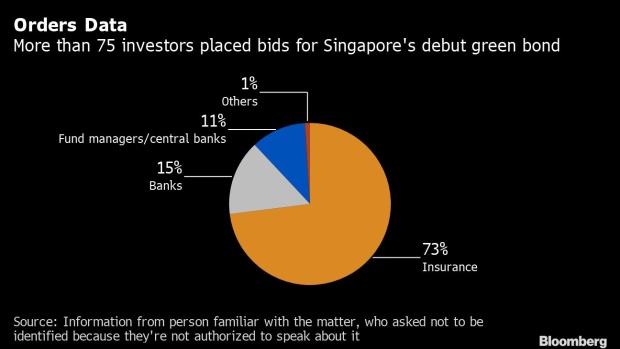

The deal was more than twice oversubscribed by institutional investors. The biggest segment of bids came from insurance companies, who often hold bonds until maturity. The offering attracted interest from European investors as well as those in Asia, according to people familiar with the matter who requested anonymity discussing private matters.

The purchase window for retail investors runs until Aug. 10.

(Updates with details on investor mix and analyst comments; an earlier version of this story was corrected for a number in the chart)

©2022 Bloomberg L.P.