Mar 21, 2023

Soaring Costs, Fresh Rains Put Morocco Rate Hike on Cards

, Bloomberg News

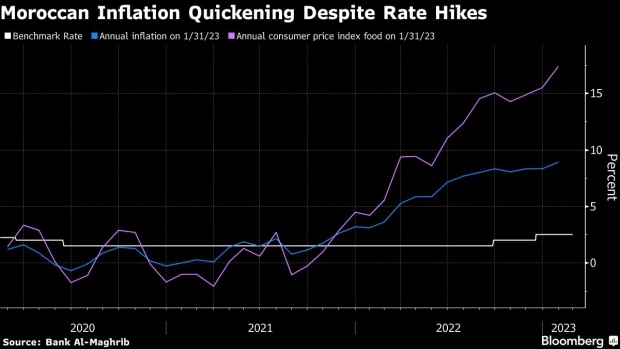

(Bloomberg) -- Morocco looks set to extend its cycle of monetary tightening into this year, doubling down on efforts to tame the fastest inflation in decades by continuing with its first interest-rate increases since 2008.

Three of the kingdom’s major financial institutions expect Bank al-Maghrib to increase the benchmark by between 25 and 50 basis points from its current 2.5% at Tuesday’s quarterly policy meeting. That would follow hikes of 50 basis points apiece in September and December.

Tackling a surge in consumer prices is shaping up as the top priority for Morocco, which has seen small-scale protests in several cities over the soaring costs of staples like tomatoes and onions. Bearing the blame are higher import bills in the wake of Russia’s invasion of Ukraine and Morocco’s more frequent and severe droughts, which have battered the key agricultural sector.

Authorities need to tackle “tenaciously high inflation,” and a boost in farming output spurred by recent rainfall should help fuel economic growth and offset the impact of more rate hikes, Bank of Africa’s research unit said in a note.

Annual inflation hit 8.9% in January, more than double the central bank’s target for 2023. Tightening may help cool the index until better agricultural output eases pressure on homegrown food prices later in the year.

Morocco was little touched by the wave of popular uprisings across the Middle East and North Africa in the 2010s, making any signs of unrest particularly striking. The World Bank sees its economy, in which tourism and exports to Europe play an important role, expanding 3.1% this year, while warning of risks from the Ukraine conflict and potential climate shocks.

Morocco asked the International Monetary Fund for a $5 billion credit line earlier in March to guard against global uncertainties.

Addressing a recent investment conference, central bank Governor Abdellatif Jouahri said the regulator’s focus remains on bringing down inflation, even while Morocco’s economy is performing “below expectations.”

That’s left about half of the 35 “most influential” investors in Morocco’s financial markets expecting a 50 basis-point rise, and 39% foreseeing a 25-point hike, according to a survey by Attijari Global Research, a unit of the country’s biggest lender.

Tightening “can certainly have undesirable impacts in the short term, but the cost of non-action is much higher in the medium and long term,” Jouahri said. “There can be no sustainable and inclusive growth without macroeconomic stability, in particular that of prices.”

(Updates with details of policy in first paragraph.)

©2023 Bloomberg L.P.