Trump Lawyer Hints That Tabloid CEO Tried to Help Model’s Career

Donald Trump’s lawyer sought to cast doubt on claims that a tabloid publisher’s $150,000 deal with a onetime Playboy model was an attempt to influence the 2016 election.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Donald Trump’s lawyer sought to cast doubt on claims that a tabloid publisher’s $150,000 deal with a onetime Playboy model was an attempt to influence the 2016 election.

Mexican companies are pushing ahead with plans to sell shares, seeking to tap renewed interest from global equity investors, according to the head of Barclays Plc in the country.

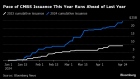

Commercial real estate was one of the scariest assets in the US last year. This year, investors are warming to it once again — and that’s helped revive a key property debt market.

Novaland Investment Group, among Vietnam’s largest real estate developers, is planning to sell shares and increase borrowings after securing bondholders’ approval to restructure $300 million of notes to address a liquidity crunch.

Signa Prime Selection AG has agreed to sell three Italian properties, including the five-star Hotel Bauer in Venice, to the Schoeller Group.

Oct 21, 2020

, Bloomberg News

(Bloomberg) -- Standard Chartered Plc will rent space in an Indian project being developed by a local builder and Singapore’s sovereign wealth fund to create one of its biggest campuses.

The London-based bank’s Standard Chartered GBS unit will lease 770,000 square feet for 15 years in the southern Indian city of Chennai, in a project being developed by DLF Ltd. and GIC Pte., DLF’s Executive Director Amit Grover said by phone on Wednesday. He declined to share a deal value citing client confidentiality.

Standard Chartered could pay as much as 1 billion rupees ($14 million) each year, according to the Economic Times, which reported the deal earlier without saying where it got the information. Construction began in January 2020 and is scheduled to be completed in phases over three to six years, according to DLF’s website.

It’s rare for a large firm to commit to under-construction projects in India. However, India’s office-property market has been gaining the attention of large global buyers in recent years, with investors including Blackstone LP and Brookfield Asset Management Inc. looking to purchase rent-yielding local properties backed by marquee clients.

A representative for Standard Chartered didn’t immediate reply to an email.

Rentals aren’t very different from levels seen before the coronavirus pandemic, Grover said.

“It will involve three years for construction and a 15-year relationship on the lease, so it’s an 18-year relationship,” Grover said. “Matured partners don’t look at short term impact.”

©2020 Bloomberg L.P.