Oct 17, 2022

S&P 500 bounces off make-or-break technical level

, Bloomberg News

BNN Bloomberg's closing bell update: October 17, 2022

Stocks saw big gains Monday, with the S&P 500 closing above a key technical level and another giant bank coming out with solid results. A reversal of the U.K.’s vast fiscal stimulus also bolstered trader sentiment.

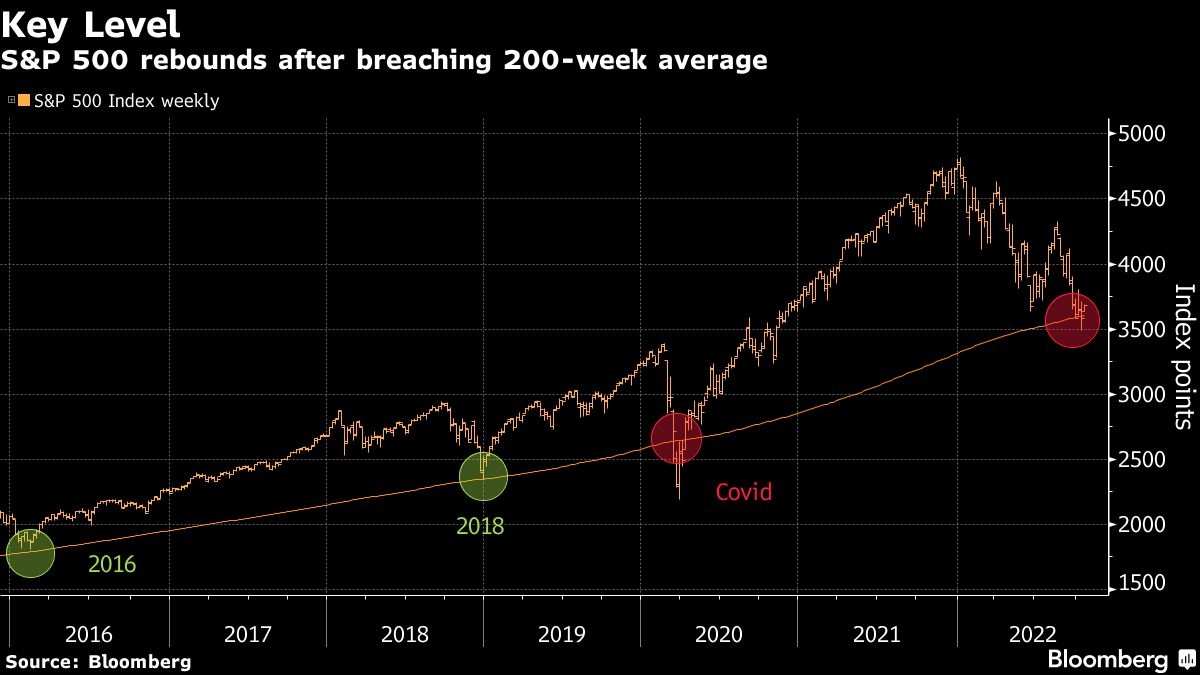

The breadth of the rally was so strong that at one point over 99 per cent of the companies in the U.S. equity benchmark were up, with the gauge pushing away from its 200-week moving average. The tech-heavy Nasdaq 100 outperformed, notching its biggest gain since July.

A rout in the S&P 500 has left the index testing a “serious floor of support,” which could lead to a technical recovery, Morgan Stanley’s Mike Wilson wrote. The strategist, who’s one of Wall Street’s most-prominent bearish voices, said he “would not rule out” the measure rising to about 4,150. That’s 13 per cent above current levels.

“Stocks may be ripe for a near-term bounce,” wrote BCA Research strategists led by Roukaya Ibrahim. “While economic conditions have not changed -- and therefore do not warrant a shift in the cyclical outlook -- technical conditions are pointing to a potential rebound.”

The arrival of earnings has historically served as a remedy for ailing equities, lifting the S&P 500 roughly 76 per cent of the time since 2013. Cut-to-bone profit estimates are making the hurdles easy to clear.

To Jeffrey Buchbinder at LPL Financial, while expectations are indeed very low for the current earnings season, forecasts for 2023 still remain elevated.

“The tough part is figuring out how far estimates need to fall and how much of a headwind that haircut will be for stocks as they try to dig their way out of this bear market,” he added.

Markets have historically bottomed out when investors began to contemplate materially looser policy over the next six to 12 months, when a trough for economic activity was in sight or when valuations reflected a “bear case” scenario, according to Mark Haefele at UBS Global Wealth Management.

“We do not believe these conditions have been fulfilled,” Haefele added. “Despite the increased risks to growth and the rise in volatility, equity markets have neither become cheaper relative to bonds, nor yet priced in a material slowdown in growth and earnings.”

Some 86 per cent of respondents in the latest MLIV Pulse survey expect U.S. markets to recover first, with investors slightly favoring stocks over bonds.

The result suggests the longstanding premium for equities will remain in place — and as the Federal Reserve’s peak hawkishness becomes apparent, traders will be prepared to return to Treasury markets in droves.

The latest U.S. recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher probability of such an event across all time frames -- with the 12-month estimate of a downturn by October 2023 hitting 100 per cent. That’s up from 65 per cent for the comparable period in the previous update.

Data Monday showed a measure of New York state manufacturing contracted for a third month in October, and a larger share of factories were more downbeat about business conditions in early 2023. The prices-paid measure rose for the first time since June.

“This isn’t a Pollyanna moment,” said Robert Teeter, a managing director of Silvercrest Asset Management. “Inflation clearly remains a problem until proven otherwise, and disappointing earnings, particularly from consumer facing-companies, could trigger another rough stretch, with recession fears at the fore.”

Key events this week:

- U.S. industrial production, NAHB housing market index, Tuesday

- Fed’s Neel Kashkari speaks, Tuesday

- Euro area CPI, Wednesday

- EIA crude oil inventory report, Wednesday

- U.S. MBA mortgage applications, building permits, housing starts, Fed Beige Book, Wednesday

- Fed’s Neel Kashkari, Charles Evans, James Bullard speak, Wednesday

- U.S. existing home sales, initial jobless claims, Conference Board leading index, Thursday

- Euro area consumer confidence, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 2.7 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 3.5 per cent

- The Dow Jones Industrial Average rose 1.9 per cent

- The MSCI World index rose 2.1 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.7 per cent

- The euro rose 1.2 per cent to US$0.9837

- The British pound rose 1.6 per cent to US$1.1352

- The Japanese yen fell 0.2 per cent to 149.04 per dollar

Cryptocurrencies

- Bitcoin rose 1 per cent to US$19,527.35

- Ether rose 1.1 per cent to US$1,325.63

Bonds

- The yield on 10-year Treasuries was little changed at 4.02 per cent

- Germany’s 10-year yield declined eight basis points to 2.27 per cent

- Britain’s 10-year yield declined 36 basis points to 3.98 per cent

Commodities

- West Texas Intermediate crude fell 0.2 per cent to US$85.40 a barrel

- Gold futures rose 0.3 per cent to US$1,653.70 an ounce