Mar 19, 2024

Swiss Government Cuts Its Inflation Forecast to 1.5% This Year

, Bloomberg News

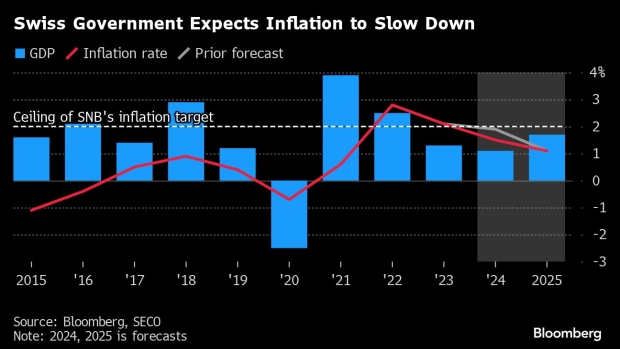

(Bloomberg) -- Switzerland’s government cuts its inflation forecast owing to weaker price growth at the start of the year, a piece of evidence that could support an earlier-than-expected cut from the central bank this week.

Consumer prices will grow at an annual 1.5% in 2024, down from 1.9% in its prior forecast, the State Secretariat for Economic Affairs said on Tuesday. In 2025, the inflation rate will drop to 1.1%, matching its December estimate.

Swiss National Bank policymakers will meet on Thursday for their first interest-rate decision of the year. While a majority of economists expect the central bank to wait until June before lowering borrowing costs, several don’t rule out a cut this week.

“As in other countries, inflation in Switzerland has also been declining recently, due in part to energy prices but also the strengthening of the Swiss franc,” SECO, which is responsible for drawing up the government’s predictions, said in a statement.

- The forecasts also show that the economy will expand 1.1% this year and 1.7% in 2025, unchanged from prior estimates.

- A reduction of the SECO forecast had been widely expected after the country’s January inflation reading was significantly below expectations, defying a boost in electricity prices and in value-added tax.

©2024 Bloomberg L.P.