Oct 27, 2022

Taiwan’s Economy Faces Mounting Risks From Demand Slowdown

, Bloomberg News

(Bloomberg) -- Taiwan’s economy expanded faster than expected last quarter as an easing in Covid restrictions helped to spur spending and offset sliding global demand for its exports.

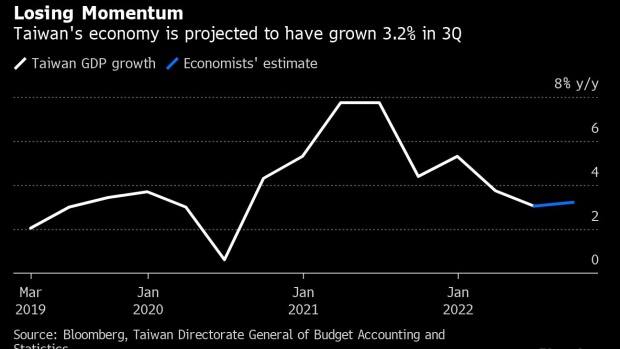

Gross domestic product grew 4.1% in the July-to-September period from a year ago, the Directorate General of Budget Accounting and Statistics said Friday, much higher than the 3.2% growth expected by economists in a Bloomberg survey. That was the strongest expansion since the final three months of 2021.

Officials attributed the increase to a rise in domestic demand, boosted in part by easing Covid restrictions.

“The surprise was coming from private consumption, which accelerated strongly from 2.9% to 7.5%” on the recovery from Covid, government support and a low base of comparison, said Michelle Lam, Greater China economist at Societe Generale SA.

The broader picture for Taiwan is mixed, though. The numbers don’t reflect the entirety of a downturn that began weighing on trade in September. And while it outperformed economist expectations, the growth rate is weaker than an official government estimate from August of a 4.71% expansion for the quarter.

The official miss was “due to sluggish exports performance from a worse-than-expected weakening in demand,” Wu Pei-hsuan, a senior executive officer at Taiwan’s statistics bureau, told reporters at a briefing.

Worsening Trade

Taiwanese officials have already warned that the trade outlook for the rest of the year is grim after overseas shipments dropped last month for the first since 2020.

Exports and investments slowed as expected due to weak global demand, especially for tech goods as work-from-home demand normalizes,” Lam said. “The challenging tech demand outlook will continue to weigh on exports and investments, while geopolitical tensions could add further downside risks to the latter.”

Taiwan faces an number of global challenges, including high global inflation that is contributing to the slump in demand that’s dented exports and weighed on manufacturing output. China’s pursuit of Covid Zero has snarled trade with a critical economic partner, while Russia’s war in Ukraine and rising geopolitical tensions between the US and China involving Taiwan have further muddled the picture.

The decline in exports in September ended a two-year period of stellar trade performance. Officials cautioned then that overseas shipments may continue to struggle through the rest of this year as demand in China and the rest of the world is sluggish, and the slowdown has begun weighing on businesses in Taiwan, with industrial production unexpectedly dropping last month as demand for manufactured goods weakened.

Added Risks

US technology restrictions on China have added to risks for Taiwan, as the island’s economy and trade is heavily reliant on exporting semiconductors. While Taiwan’s economic affairs minister downplayed the impact of new chip curbs on the economy, the US announcement still rattled the global semiconductor industry, with shares in Taiwan Semiconductor Manufacturing Co. falling dramatically.

Read More: Taiwan Needs Diverse Trade Amid US-China Row: Finance Chief

While officials have stressed a need to diversify trade with other places, China and Hong Kong remain a top destination for Taiwan’s exports.

Economists expect Taiwan’s economic growth to reach 3.2% this year before slowing to a 2.6% expansion in 2023, which would be the worst performance since 2016. On Friday, officials said 2022 GDP could rise 3.6% from last year based on the third quarter data.

Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd, said Friday’s number would still offer another reason for Taiwan’s central bank to raise interest rates when it meets in December.

“However, this should be the last hike in the current tightening cycle as the growth outlook becomes more uncertain,” he added.

--With assistance from Argin Chang and James Mayger.

(Updates with economist comments.)

©2022 Bloomberg L.P.