Jul 6, 2022

Tax Cuts and Public Sector Pay, Big Calls For New UK Chancellor

, Bloomberg News

(Bloomberg) --

Britain’s new chancellor of the exchequer, Nadhim Zahawi, is facing two big calls as he tries to juggle the conflicting pressures of rising inflation and the cost-of-living crisis.

He has already said he is “determined to do more” on cutting taxes, in an attempt to ease the living standards squeeze on households, boost economic growth and placate fellow Conservatives who fear the party is losing its low-tax reputation. The Bank of England is forecasting two years of stagnation.

Zahawi may flesh out his thoughts next week in a scheduled joint statement on the economy with the prime minister. More immediately, he faces a decision on public-sector pay with the prospect of a series of devastating strikes over the summer if government workers are awarded sub-inflation rises.

The risk the new chancellor faces is that more financial support for households and big pay rises for civil servants will only stoke inflation and drive up debt-interest costs, leaving the government with less money to spend on public services.

Zahawi acknowledged the problem, telling the BBC on Wednesday morning: “The important thing is fiscal discipline -- that is what we have got to do because we have got to bear down on the blight of inflation.”

However, in his resignation letter on Tuesday evening, Rishi Sunak suggested that he was quitting as chancellor in part because Prime Minister Boris Johnson was not prepared “to take difficult decisions.”

What Bloomberg Economics Says...

“The appointment of Zahawi looks likely to concide with a shift toward easier fiscal policy in the UK, at least in the near term.”

Areas that will be top of the new Chancellor’s in-tray include:

- More cost of living support

- A strategy on corporate tax

- Looking at personal taxes

--Dan Hanson, senior UK economist. Click here for the full report.

The government’s Pay Review Bodies have reported back and are recommending big increases. Departments have been asking for more cash but, under Sunak, the Treasury has been demanding they find the money by cutting staff and making other savings.

Sunak feared that tax cuts and pay rises of close to the current 9.1% inflation rate would only drive inflation higher, rather than boost growth. That would force the BOE to hike interest rates aggressively, making government debt even more expensive to service.

The debt-interest bill this year is already forecast by officials to be almost £90 billion ($107 billion), around twice the defense budget. In reality, it’s likely to be much higher. A quarter of all government bonds is tied to RPI inflation, which is already in double digits and projected to accelerate further.

Sunak hinted in his letter of resignation that the prime minister wanted the near impossible combination of lower taxes, big wage rises, controlled inflation and strong public finances.

“If something is too good to be true, then it’s not true,” he said. “It has become clear to me that our approaches are fundamentally too different.”

As Education Secretary, Zahawi asked for a 9% pay rise for new teachers. He also wanted a 5% increase for senior teachers, above the government’s preferred level of around 3%. The increase for new teachers was budgeted for last October.

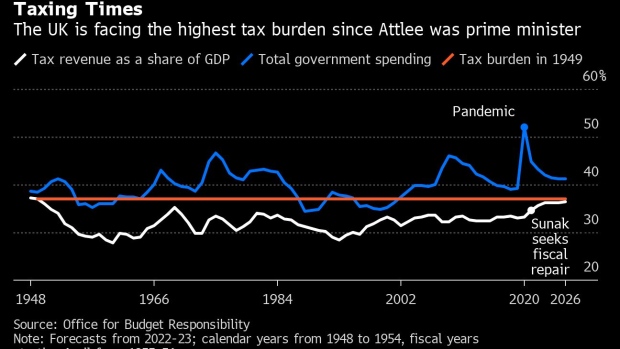

He has also signalled his desire for tax cuts. Although Britain is modestly taxed compared with countries such as France, Germany and Italy, increases introduced under Sunak mean the tax burden is on course to reach its highest level since the late 1940s.

Many Conservatives fear the party is losing its traditional reputation for keeping spending and taxes low, and paying a high price with voters as a result.

For Zahawi, there are a number of options.

To ease the income squeeze on households, a value-added tax cut on energy bills and fuel prices is one. The policy has been promoted by the opposition Labour Party and looked into by the Treasury.

Its advocates argue that a VAT cut would reduce inflation mechanically, as VAT is part of the consumer price. A 5% VAT cut on household energy bills would cost about £2 billion, the Resolution Foundation think tank has estimated.

Other options include a reform of business rates, to reduce the cost of doing business. Companies have long wanted reform and the Treasury has had the tax under review for three years.

A reduction in business rates could be partially offset by the introduction of an online sales tax, which has been in design for several years. It could be expensive, though, as business rates raise more than £30 billion a year.

Sunak was planning to reveal next week a replacement for his super-deduction tax relief on investment, which is due to end in March next year when the main tax rate on company profits jumps 6 percentage points to 25%.

Johnson was reported to be considering a full U-turn to leave the corporation tax rate at 19%, which would have cost the exchequer around £12 billion.

An alternative said to be under consideration is a tapering of the corporation tax rise, combined with a replacement investment tax relief. The plan would see corporation tax reach 25% over a number of years rather than a single shock. Again, doing so would drive public borrowing higher.

Low-tax Tories have also been calling for a payroll tax increase that came into effect in April be reversed.

The government has partially addressed that issue already by raising the threshold at which national insurance contributions are paid by £2,690 to £12,570 as of today. The move will save taxpayers an average of £330 a year and take low earners out of the net altogether.

©2022 Bloomberg L.P.