May 22, 2019

Tesla Bears Keep Piling On as Citi Lowers Target

, Bloomberg News

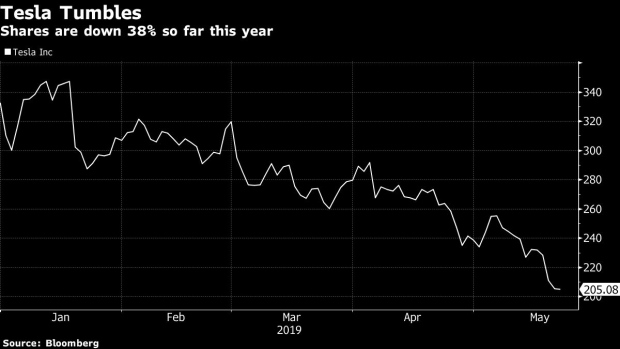

(Bloomberg) -- Another analyst is cutting his price target for Tesla Inc., after the electric carmaker on Tuesday fell to the lowest since December 2016.

Citigroup analyst Itay Michaeli lowered his price target to $191 from $238, highlighting “negatively skewed” risks, and lingering demand and cash flow concerns. Tesla is down another 1.5% pre-market Wednesday, extending a five-day decline. Shares closed down 0.1% at $205.08 on Tuesday after trading below $200 during the day.

Tesla’s $2.4 billion capital raise this month was“ a positive step but won’t necessarily get the balance sheet out of the woods” if the company can’t meet free cash flow targets, Michaeli wrote in a note. “An automaker’s balance sheet is always subject to the confidence ‘spiral’ risk,” and Tesla must provide a “more formal” outlook, good or bad, soon.

Michaeli said Tesla may have erred by “externally targeting level-5/urban robotaxis next year, a claim that ultimately hurt credibility,” though the company’s AV pivot “aligns well” with Citi’s long-term views about the industry.

Earlier this week, Tesla sustained multiple blows at the hands of Wall Street analysts:

Morgan Stanley slashed its worse-case scenario for the share price to just $10 over concern Tesla has saturated the electric-car market. Robert W. Baird & Co.’s longtime Tesla bull Ben Kallo said it may take several months for the negative narrative surrounding the carmaker to shift, and cut his price target to $340 from $400. Wedbush analyst Dan Ives wrote that Tesla faces a “Kilimanjaro-like uphill climb” to hit targets for profitability in the second half of the year. He cast doubt on underlying demand for the company’s first mass-produced vehicle, the Model 3 sedan, and cut his price target to $230.

Wall Street wasn’t alone in throwing shade on Tesla. On Wednesday, Consumer Reports said Tesla’s lane-changing feature has safety issues, with the Model 3 shifting lanes in ways that “a safe human driver would not.”

To contact the reporter on this story: Felice Maranz in New York at fmaranz@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Scott Schnipper

©2019 Bloomberg L.P.