Jan 16, 2024

Tether’s Reserves Do Exist. Cantor Fitzgerald CEO Says

, Bloomberg News

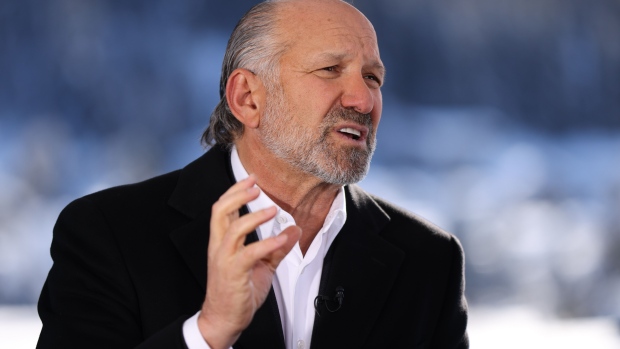

(Bloomberg) -- Cantor Fitzgerald LP Chief Executive Officer Howard Lutnick said his firm has reviewed some of Tether Holdings Ltd.’s balance sheet as the stablecoin issuer’s custodian and confirmed it holds the money it says it does.

Tether reported assets of about $86 billion at the end of June to back about $83 billion of its USDT stablecoin, Lutnick noted. He said Cantor Fitzgerald manages “many many” of those assets for Tether, which serves as a foundation for much of the cryptocurrency market and has faced speculation for years that its coin wasn’t backed one-to-one with dollars as claimed.

“They have the money they say they have,” Lutnick said in an interview with Bloomberg Television’s Lisa Abramowicz, Jonathan Ferro and Annmarie Hordern from the World Economic Forum in Davos. “I’ve seen a whole lot and the firm has seen whole a lot and they have the money. And so there has always been a lot of talk ‘Do they have it or not?’ and I’m here with you guys and I’m telling you we’ve seen it and they have it.”

Tether confirmed its relationship with Cantor Fitzgerald in March of last year.

Read more: Stablecoin Tether Grows Into Crypto World’s $69 Billion Mystery

Tether’s USDT is the largest stablecoin in crypto with a circulation of roughly $95 billion, according to data from CoinGecko. It’s an influential participant in the global crypto ecosystem and, as such, has been a lightning rod for criticism and regulatory scrutiny.

“While naysayers have had their go at Tether over the years, it’s heartening to hear Cantor Fitzgerald CEO Howard Lutnick affirming the robustness of our reserves,” Tether CEO Paolo Ardoino said in an emailed statement.

In 2021, Tether paid more than $40 million to settle allegations by a US watchdog that it had lied about its collateral pile. The company began publishing attestations of its reserves with a third-party accounting firm that year. These documents are a snapshot-in-time view of its holdings, rather than a full audit.

A report this month by the United Nations Office on Drugs and Crime described USDT as a popular choice for money laundering and illicit transactions. In response to the report, Tether said it was committed to combating the criminal use of cryptocurrencies and said the ease of tracking transactions on the blockchain makes the tokens “an impractical choice for illicit activities.”

Read more: Stablecoin Tether Grows Into Crypto World’s $69 Billion Mystery

In addition to leading Cantor Fitzgerald, Lutnick is also chairman and CEO of the brokerage BGC Group Inc. In the wide-ranging interview, Lutnick said his brokerage business has been aided by a resurgence in trading volumes across Wall Street.

“For the banks, trading markets are back,” Lutnick said. “You’re going to see the banks do really, really well through this and they’re going to be a wonderful performing asset in 2024.”

BGC has been seeking approval from US regulators to expand its FMX platform to offer futures trading. Lutnick said on Tuesday he’s already lined up partnerships with almost every major US bank for the new platform, which he expects to debut later this year after securing full regulatory approval from the Commodity Futures Trading Commission.

Lutnick also joined other financial executives in warning that investors betting on a series of interest-rate cuts in the US could prove to be mistaken. Assets prices are now signaling that investors are assuming inflation will drop soon, allowing the Federal Reserve to quickly cut rates while avoiding a recession in the US.

Read more: Bridgewater’s Jensen Says Assets Priced for Perfection a Concern

Money markets are betting on six quarter-point reductions at the Federal Reserve this year and more than a 50% chance of a seventh move, according to swaps tied to policy-meeting dates. The first such cut is expected by May.

“No way at all, that is just a nonsense,” Lutnick said. “You go to the supermarket, you do all the things we all do, you gotta be kidding me. Inflation is not in the rearview mirror, and, therefore, we are going to stay higher for longer.”

--With assistance from Emily Nicolle, Yueqi Yang and stacy-marie ishmael.

(Updates with comment from Tether in sixth paragraph.)

©2024 Bloomberg L.P.