Aug 16, 2018

Teva gets U.S. FDA approval for first ever generic EpiPen

, Bloomberg News

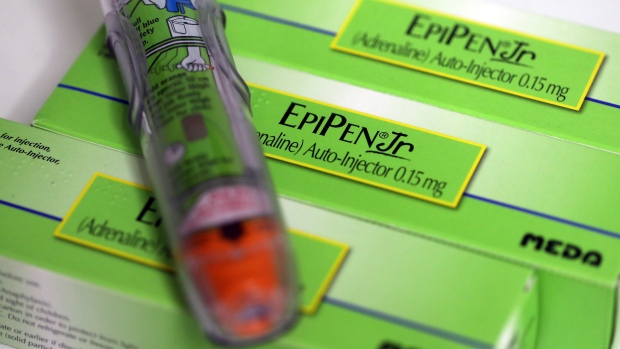

EpiPen, a life-saving allergy treatment widely criticized for its high price tag, will get generic competition for the first time since the autoinjector was approved more than two decades ago.

The Food and Drug Administration on Thursday cleared Teva Pharmaceutical Industries Ltd.’s generic EpiPen and EpiPen Jr. for sale, several years after the Israeli drugmaker filed for approval. Mylan NV has attempted to thwart competition from Teva, claiming that differences in how the epinephrine-injecting devices work would confuse patients. Mylan takes in about US$1 billion a year in EpiPen sales.

Teva’s American depositary receipts rose 7.1 per cent to US$24.06 at 1:02 p.m. in New York. Mylan fell 0.4 per cent to US$37.68.

FDA Commissioner Scott Gottlieb has pledged to help copycats of complex drug-device combinations, such as the EpiPen, find a way to market. The strategy is part of a sweeping effort by the Trump administration to bring down drug prices with more low-cost competition.

Mylan acquired the rights to sell EpiPen in 2007, when it cost about US$57 per shot. The market leader, which is run from Canonsburg, Pennsylvania, came under fire two years ago from patients and U.S. lawmakers for raising the price of EpiPen to US$600 for a two-pack of the autoinjecting pens.

Mylan then introduced a generic version of its own device at US$300 for a two-pack. In May, the FDA placed the EpiPen on its list of drugs in shortage after more than 400 patients in 45 states reported difficulty filling prescriptions following manufacturing issues at a Pfizer Inc. factory that makes the devices for Mylan.

“This approval means patients living with severe allergies who require constant access to life-saving epinephrine should have a lower-cost option, as well as another approved product to help protect against potential drug shortages,” Gottlieb said in a statement.

Name Recognition

Mylan has faced competition from other autoinjectors -- Impax Laboratories LLC’s Adrenaclick and Kaleo Inc.’s Auvi-Q -- but neither are generic. (Typically, generics can be automatically substituted for the brand name by a pharmacist.) The two rivals haven’t sold nearly as well as EpiPen without name recognition. Adrenaclick is also on FDA’s shortage list.

The FDA previously rejected Teva’s generic EpiPen in 2016 after citing “major deficiencies” in the proposal. Unlike Mylan’s one-cap EpiPen, Teva’s proposed generic substitute had two caps, including a removable one that covers the spot where its needle extends. The difference in caps would confuse patients and could prove dangerous, Mylan had argued. It wasn’t immediately clear how the cap situation was resolved as part of Teva’s approval.

Mylan’s cap is nonremovable, a fairly recent innovation that prevents users from accidentally pricking themselves or others. Mylan argues that the updated cap along with other advancements are critical to the pen’s safety and functionality. It acquired new patents on the device that prevented others from copying its design until 2025.

--With assistance from Cynthia Koons