Jul 18, 2022

The ECB’s New Bond Tool May Be Tested Sooner Than Expected

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The European Central Bank’s new tool to counter unwarranted jumps in euro-area borrowing costs may be tested sooner than expected as fresh political uncertainty engulfs Italy.

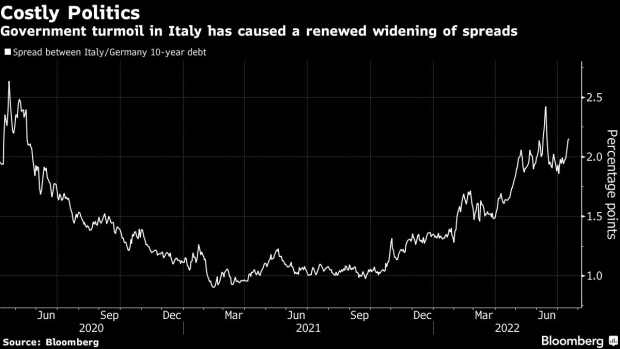

With Prime Minister Mario Draghi’s government on the brink of collapse, the spread between 10-year Italian bonds and their German counterparts has surged past 200 basis points -- a threshold the country’s central bank chief has previously called unjustified. That risks raising pressure on the ECB to make its instrument easier to activate.

“The features of the ongoing political drama in Italy raise questions on at least two key issues,” AXA chief economist Gilles Moec said Monday in a report to clients. “Can conditionality be light, and what exactly are the ‘right circumstances’ under which the tool could be deployed?”

There’s a risk the instrument -- due to be unveiled Thursday as the ECB raises interest rates for the first in more than a decade -- “could still be too vague, or too narrow in scope, to signal the market that the ‘cavalry is coming’ quickly to shore up the Italian bond market,” he said.

Officials envisage a backstop for emergencies where their efforts to combat record inflation are at risk -- not a measure to rescue governments facing political turmoil. Bundesbank President Joachim Nagel wants firm conditions for when it can be used.

Political drama is unlikely to trigger the instrument -- at least not to shore up Italian bonds, according to Silvia Ardagna, head of European economics at Barclays.

“It will not be used if the spread widens during a time of political crisis in Italy -- it’s not just because of resistance from the Germans, but it’s also a legal issue,” she told Bloomberg Television. “In this circumstance, the gray area might be way too gray for the ECB to intervene. Perhaps the usefulness of this tool might be to shield other countries from spillovers from Italian political developments.”

©2022 Bloomberg L.P.