Jun 24, 2019

The Sneaking Suspicion the RBNZ Could Spring a Surprise Rate Cut

, Bloomberg News

(Bloomberg) -- Under governor Adrian Orr, New Zealand’s central bank has shown it’s not afraid of springing a surprise. That’s why some economists and traders have a sneaking suspicion it could cut interest rates tomorrow.

Conventional wisdom says the Reserve Bank’s monetary policy committee will wait until August, when it will have move information to justify another reduction. But the move toward lower rates globally, coupled with weak domestic economic data, makes a case for getting on with the job -- even as all 24 economists surveyed by Bloomberg expect no change.

“We expect the bank to keep the cash rate unchanged at 1.5%, preferring to wait another six weeks for the more in-depth forecasting update in August,” said Jarrod Kerr, chief economist a Kiwibank in Auckland. “But we certainly wouldn’t rule out a cut on Wednesday, given the race to lower rates offshore.”

Wednesday’s rate decision, due at 2 p.m. in Wellington, is a standard review of the official cash rate. It’s not accompanied by fresh forecasts or followed by a press conference from Orr. Investors see a 20% chance of a cut tomorrow, but have almost fully priced in an easing in August, swaps data show.

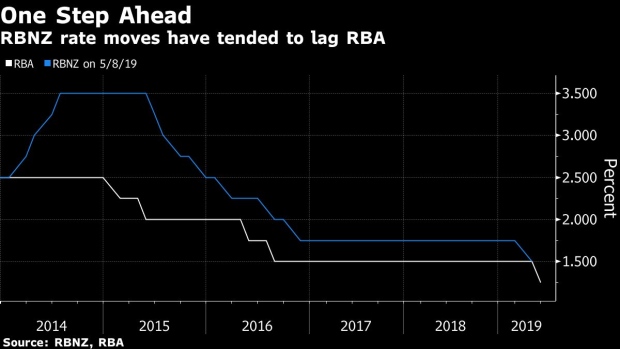

When Orr cut the OCR to a fresh record low in May -- matching the Reserve Bank of Australia’s cash rate for the first time in five years -- he said the outlook for rates was now more balanced, suggesting a wait-and-see stance. Since then, however, the RBA has cut rates and the U.S. Federal Reserve and European Central Bank have both signaled an easing bias.

“In May, the Reserve Bank intimated that it wanted to keep in front of the curve,” said Craig Ebert, senior economist at Bank of New Zealand in Wellington. “If this remains its reasoning, then the door to a June ease is definitely opened.”

Recent data have done nothing to dispel the view that a further rate cut is on the cards.

While economic growth was slightly faster than the RBNZ expected in the first quarter, underlying indicators added to signs of softer domestic demand. Manufacturing growth almost stalled in May and services industry activity was at a six-year low in April.

At the same time, the central bank may want to see the next inflation and employment data, due in July and August, before deciding whether to pull the trigger on another rate reduction.

“On balance of probability, we expect the RBNZ committee to hold at 1.5% this Wednesday afternoon,” Ebert said. “Nonetheless, in the least, it will probably sound dovish enough to leave the market largely pricing another 25-point cut at the August Monetary Policy Statement.”

To contact the reporter on this story: Matthew Brockett in Wellington at mbrockett1@bloomberg.net

To contact the editors responsible for this story: Matthew Brockett at mbrockett1@bloomberg.net, Tracy Withers

©2019 Bloomberg L.P.