Nov 3, 2022

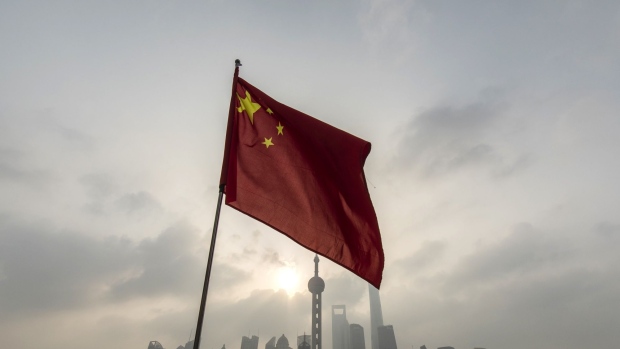

Tiger Global Funds Cut China Exposure and Pause New Stock Bets

, Bloomberg News

(Bloomberg) -- Tiger Global Management, a long-time investor in China, has pulled back from the region and is pausing future stock investments.

The firm’s hedge and long-only funds have been reducing their exposure to the country this year and continued to do so last month, shrinking the percentage of Tiger Global’s portfolio there from the mid-teens to mid-single digits, according to people familiar with the matter.

The adjustments reflect the firm’s view that geopolitical tensions and China’s Zero Covid policy, with lockdowns and quarantines, are all the more likely to persist after President Xi Jinping last month clinched a precedent-defying third term in office. Still, the money manager also sees a potential for the president to stimulate the economy to hit goals for the future.

Tiger Global gained renown for its early bets on China, snapping up battered internet stocks there in 2002, but the market has become a minefield for investors in the past few years. Chinese regulators cracked down on the tech sector last year, imposing new restrictions and taking some executives into custody, sending once-high-flying stocks tumbling. Lockdowns have complicated companies’ operations. There are also heightened tensions with the US.

The Hang Seng Index is down almost 44% since the end of 2020 through Thursday, compared with the S&P 500’s decline of less than 1%.

For now, Chase Coleman’s firm doesn’t intend to snap up Chinese stocks on the cheap and is taking a wait-and-see approach to investments there until Xi’s next public statements, the people said. Instead, it’s focusing on India and Southeast Asia.

The funds’ remaining China exposure is tied mostly to food delivery titan Meituan and online retailer JD.com, though even those positions have shrunk, the people said.

A company spokeswoman declined to comment. The Wall Street Journal reported the firm’s decision earlier Thursday.

(Updates with Tiger Global’s background in China from fourth paragraph.)

©2022 Bloomberg L.P.