Dec 25, 2023

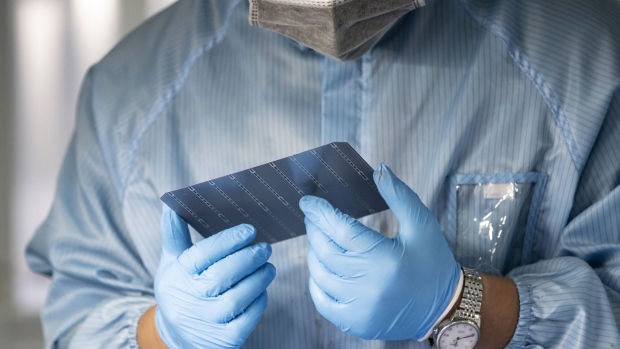

Top Chinese Solar Firm Tongwei Plans $4 Billion Factory as Consolidation Looms

, Bloomberg News

(Bloomberg) -- Tongwei Co., the world’s largest manufacturer of a key material for solar panels, said it will build a massive new factory in northern China just as the industry struggles with a price war and a looming wave of consolidation.

Tongwei has agreed with local authorities in Ordos, Inner Mongolia, to invest 28 billion yuan ($3.9 billion) in a two-phase project that will eventually have capacity to produce 500,000 tons of industrial silicon and 400,000 tons of polysilicon annually, the Chengdu, Sichuan-based company said in a stock exchange filing on Monday.

Tongwei’s shares fell as much as 0.8% on Tuesday, while South Korean rival OCI Holdings Co. dropped as much as 3%.

The expansion plan comes as solar manufacturers contend with falling profitability. The Chinese market’s accelerated growth in output isn’t being matched by demand, and a polysilicon maker in Inner Mongolia stopped production last week in a possible sign of the effects of severe overcapacity.

Sector Recovery

Tongwei’s new plant is designed to benefit from low raw material costs and will start to serve the market in 2026, once the sector has recovered from the current round of consolidation, the company said in a separate statement.

Global polysilicon production capacity was 1.1 million tons as of late March, according to data compiled by BloombergNEF, while another 2.6 million tons of manufacturing capacity had been announced or started construction.

The first phase of Tongwei’s project will deliver about half of its planned capacity by the end of December 2025, according to the filing. The timing of the second phase will depend on market conditions. The facility will be funded from the company’s existing capital and via loans from financial institutions, it said.

China’s solar sector has entered the worst part of a phase of consolidation that will see the number of manufacturers dwindle over the next 12 to 18 months, one of the top executives at GCL Technology Holdings Ltd., a leading polysilicon maker, said in an interview earlier this month. About a quarter of polysilicon makers could be forced out of business, he said.

--With assistance from Dan Murtaugh.

©2023 Bloomberg L.P.