Jul 14, 2019

Top Thai Bank Sees Digital Platform Driving Surge in Loan Growth

, Bloomberg News

(Bloomberg) -- Siam Commercial Bank Pcl expects digital lending to retail customers to climb almost eight-fold this year as Thailand’s biggest lender accelerates its online drive to win business.

Credit card and personal loans via the bank’s mobile phone application will rise to at least 18 billion baht ($582 million) this year from about 2.3 billion baht in 2018, said Co-President Apiphan Charoenanusorn. A $1 billion investment to support the technology, due to be completed this year, has helped the online retail banking expansion, she said.

“Online and digital services will be our key to survival and growth as the cost of getting new customers is cheaper and the target group is wider,” Apiphan, 54, said in an interview on Thursday.

Thai banks and finance firms have teamed with technology companies to target individuals as they seek to boost loan growth, with more people turning to financial institutions for funds that are cheaper than those from informal lenders. Still, increasing domestic household debt has prompted the central bank to tighten supervision of mortgage lending and other consumer loans.

“Thai banks are facing a very tough situation from fintech companies, which have taken a big shares of fees from banking services,” said Tanadech Rungsrithananon, an analyst at RHB Securities (Thailand) Pcl. “Digital lending would be another challenge because this kind of loan carries very high risk without proper management.”

Muangthai Capital Pcl, the nation’s biggest non-bank lender of consumer loans, Krungthai Card Pcl and Srisawad Corp. have emerged among the best performers among Asian peers in the past month on optimism about loan demand. They earn annual interest rates of more than 20% on personal loans, still more attractive to consumers who face monthly charges of more than 5% from loan sharks.

Siam Commercial, which counts King Maha Vajiralongkorn as its biggest shareholder, plans to boost investment in overseas technology businesses, building on its partnership with ride-hailing giant Go-Jek, according to Apiphan. The tie-ups would help tap surging demand among more than 40 million Thai cell phone users for online services ranging from financial products to food delivery, she said.

The bank has 16 million retail customers, of which 10 million use its mobile phone apps for banking transactions, Apiphan said. It aims to expand online services to more than 40 million Thais with mobile phones, she said.

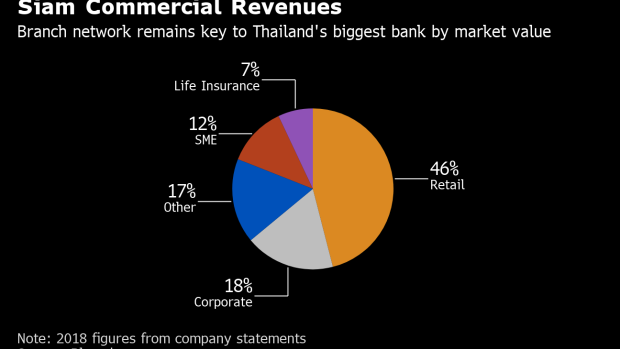

Siam Commercial gets about half its revenue from retail loans for automobiles, homes and personal spending, according to data compiled by Bloomberg. Its shares have gained 3% this year, lagging behind an 10.7% rally in the benchmark SET Index.

--With assistance from Lee Miller.

To contact the reporter on this story: Anuchit Nguyen in Bangkok at anguyen@bloomberg.net

To contact the editors responsible for this story: Sunil Jagtiani at sjagtiani@bloomberg.net, Margo Towie, Shamim Adam

©2019 Bloomberg L.P.