Jan 26, 2022

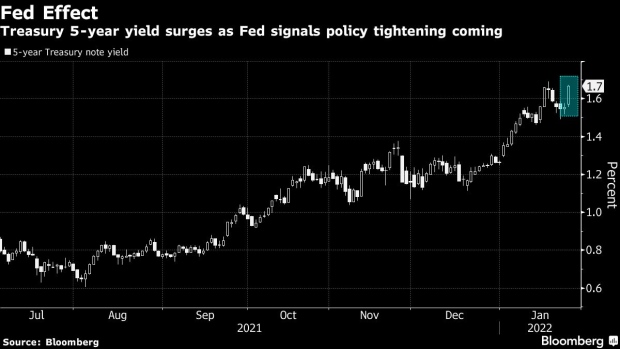

Treasury Yields Surge as Fed Tees Up Hikes and Asset Reductions

, Bloomberg News

(Bloomberg) -- Treasury yields rose across the curve after the Federal Reserve set the stage for a possible policy rate hike in March and the likely whittling down of its near $9 trillion in assets later this year.

Fed Chairman Jerome Powell in his comments to reporters said inflation remains well above the central bank’s target and the labor market was “very, very strong,” and not at risk from policy normalization.

The tone of that remark “was bold for someone as careful as Powell,” said Alex Chaloff, co-head of investment strategies at Bernstein Private Wealth Management. “The tone in the conference was more hawkish than dovish.”

Treasury yields with 2- to five years to maturity led the rise Wednesday. With 5-year yields up about 11 basis points at 1.67%, The Fed policy-sensitive two-year note’s yield climbed nearly as much to 1.14%, up over 12 basis points. Money-market traders boosted bets and foresee about 113 basis points in hikes in 2022, up from about 100 basis points before the meeting adjourned.

“Our communication channel with the markets is now working,” Powell said. “Markets are now pricing in a number of rate increases. Surveys show that market participants are expecting balance sheet run off to begin at the appropriate time -- sometime later this year perhaps. Financial conditions are reflecting in advance the decisions we make.”

The Fed stopped short Wednesday of specifying March as the starting point of rate liftoff. It also reiterated that “risks to the economic outlook remain, including from new variants of the virus.”

Fed-Linked Swaps Show Rising Odds of Super-Sized March Hike

©2022 Bloomberg L.P.