Mar 21, 2021

Turkey Bulls Are Wrong-Footed After Central-Bank Hawk’s Ouster

, Bloomberg News

(Bloomberg) -- Global investors who had wagered on Turkey’s return to a more orthodox monetary policy braced for a rough ride after President Recep Tayyip Erdogan replaced the central bank’s hawkish governor with an advocate of low rates.

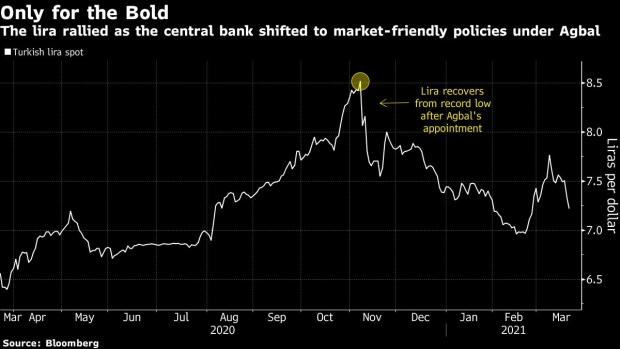

Erdogan fired Governor Naci Agbal, who had boosted the central bank’s credibility by delivering 875 basis points of interest-rate increases since his appointment in November. While Agbal’s shift toward market-friendly policies helped make the lira the best carry-trade currency this year through March 19, the gains may unravel after the president gave the job to Sahap Kavcioglu, a professor of banking at Marmara University in Istanbul and a columnist at the pro-government Yeni Safak newspaper.

Erdogan Ousts Central-Bank Head, Installs Interest-Rate Ally (3)

Kavcioglu pledged on Sunday to use monetary-policy tools effectively to deliver permanent price stability, and said the bank’s rate-setting meetings will take place according to schedule. While that may calm investors’ nerves, Agbal’s dismissal has shaken the credibility of the central bank, according to Per Hammarlund, chief emerging-markets strategist at SEB AB in Stockholm.

“Capital will flow out on Monday and the CBRT has limited resources left to protect the lira,” Hammarlund said. “A hawkish central-bank governor cannot be replaced by a dovish governor without markets expecting a shift in policy. The circumstances of Agbal’s dismissal coming two days after a rate hike will produce an even sharper shift in investor expectations.”

Broken Trust

Any weakness in the lira could add to inflationary pressures building in the economy and erode Turkey’s real rate, currently the highest in emerging markets after Egypt’s.

The lira had strengthened about 18% under Agbal’s watch as he ended a complicated funding structure and pledged to ensure price stability. His abrupt removal comes on the heels of a 200 basis-point interest-rate hike on Thursday, double what was expected in a Bloomberg survey, amid accelerating inflation.

What Bloomberg Economics Says

“The hit to the central bank’s credibility and independence can’t be overstated. Erdogan has battered the institution with interventions that have repeatedly backfired. Financial markets were willing to give Agbal a chance, his successor will find it hard to build that trust again.”

--Ziad Daoud, chief emerging markets economist. For full REACT, click here

A key concern for investors would be whether the lira will sink back to the 8-per-dollar level, which it last traded at in December.

“The political establishment and leadership is not in touch with the fundamental problems facing the Turkish economy,” said Saed Abukarsh, chief investment officer at Ark Capital Management in Dubai. “I expect that the opening will see a significantly weaker lira potentially retesting 8 handle this week as real money reassess their commitment to long-term investment.”

While Turkey’s high nominal rates are a lure for yield hunters, its mercurial inflation and the perception that central-bank policy has been too loose for the prevailing economic conditions has made the lira one of the most volatile currencies in the world.

“We must conclude, for now, that Kavcioglu will be mandated with reducing and keeping rates as low as possible,” said Cristian Maggio, head of emerging markets at TD Securities in London. “If this hypothesis proves true, not only will we see a looser policy setting in Turkey in the coming months, but we will also likely experience a return to managing policy through unorthodox measures.”

Last year, Turkish banks spent more than $100 billion of the nation’s foreign reserves to support the sinking currency, according to a report by Goldman Sachs Group Inc. That prompted calls by Turkish opposition for a judicial probe into the nation’s official reserves.

In comparison, foreign investors purchased a net $4.7 billion worth of Turkish stocks and bonds in the months following Agbal’s appointment. Overseas inflows to Turkey through swaps were about $14 billion during that period, Istanbul-based economist Haluk Burumcekci said.

Among those who may find themselves on the wrong side of the trade are Japanese retail investors. Long positions by individuals in lira-yen stood at 263,585 contracts as of Friday. They’ve climbed about 9% since the start of the year.

“We will never know how successful Agbal’s approach could have been, but initial signs were positive,” said Emre Akcakmak, a portfolio adviser at East Capital in Dubai, who anticipated challenges to intensify in the near future and a reversal on some of the recent and large hot money inflows in the face of the unexpected decision. “Even when the market stabilizes after a while, investors will have little tolerance, if any, in case the new governor prematurely cuts the rates again,” Akcakmak said.

©2021 Bloomberg L.P.