Feb 2, 2023

Turkish Inflation’s Wild Ride Down Turns Focus Back to Rate Cuts

, Bloomberg News

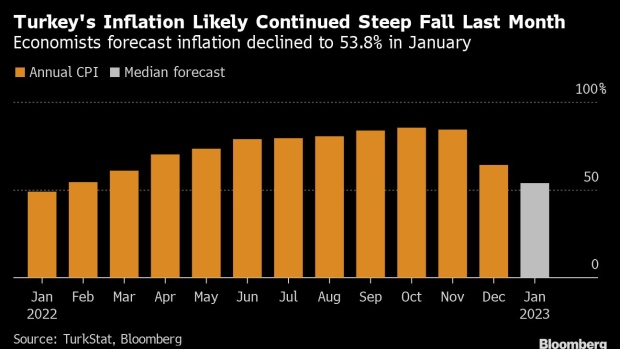

(Bloomberg) -- Turkey’s consumer inflation slowed less than forecast, even as months of deceleration are emboldening policymakers to consider interest-rate cuts ahead of approaching elections.

Consumer prices rose an annual 57.7% last month, from 64.3% in December, state statistics agency data showed on Friday. That was faster than any estimate in a Bloomberg survey of economists, whose median was 53.8%.

The risk now is that cost pressures may prove stickier than expected. Core inflation, which strips out volatile items like food and energy, quickened for the first time since October and reached an annual 53% in January.

On a monthly basis, inflation also exceeded all predictions and ticked up to 6.7%, the fastest since April 2022. The category called “unclassified services and other fees” saw the highest increase in costs from December.

Although months of relative stability in the lira and an easing of global pressures are helping cool off inflation in Turkey, favorable statistical base effects have been among the biggest drags on prices. The comparison with 2022 readings — which were exceptionally high — likely means inflation will stay in decline over the coming months.

Keeping inflation in check is crucial for President Recep Tayyip Erdogan as he vies for a third term in elections slated for May, following the worst cost-of-living crisis in two decades.

Read more: Why Turkey’s Next Election Is a Real Test for Erdogan

But in a sign the Turkish leader may not be willing to wait for price increases to stabilize at a low level, Erdogan this week renewed his call for additional rate cuts, claiming again they will bring down inflation. The opposite has been true so far, after the central bank moved to slash borrowing costs even as inflation topped 85% last year.

What Bloomberg Economics Says...

“Despite the falling inflation rate, the level remains elevated at more than 11 times the central bank’s target of 5%. The central bank, however, is likely to deliver policy rate cuts before mid-year elections — following the political leadership’s renewed call for lower rates. That will weaken the lira even as the central bank continues its back-door interventions.”

— Selva Bahar Baziki, economist. Click here to read more.

Central bank Governor Sahap Kavcioglu has fed speculation that rate cuts are back in play. Under his stewardship, the Monetary Policy Committee in January removed a phrase from its forward guidance that described the current 9% benchmark rate as “adequate.”

Policymakers then said they stood by their projections that forecast inflation will end the year at 22.3%, with Kavcioglu declining to elaborate on the likely path of interest rates.

TURKEY INSIGHT: CBRT Hidden FX Intervention at $108 Billion

With the central bank on the sidelines, the focus of efforts to restrain inflation has been elsewhere.

To keep the lira stable after four rounds of rate cuts between August and November, the central bank spent about $108 billion last year on back-door interventions in the currency market, according to Bloomberg Economics.

The government meanwhile stepped in to defend the purchasing power of consumers by raising wages, offering debt relief and providing cheap loans.

Authorities also told grocery shops to keep costs unchanged throughout January and pledged to take action against “speculative” pricing. Major chains like Migros Ticaret AS and Sok Marketler Ticaret AS quickly obliged.

While the outlook for inflation is improving, the central bank still appears to be overly optimistic. Its own monthly survey of market participants in January put year-end price growth at about 32.5%, or about 10 percentage points above the latest official forecast.

The upbeat expectations may mean a resumption of monetary easing is only a matter of time. The central bank next reviews rates on Feb. 23.

For his part, Erdogan has said inflation will “quickly slow down” and end the year at about 20%.

Morgan Stanley economists said before the data release that their base case is for Turkish inflation to slow to an annual 42% in May, “driven by strong base effects plus our assumption of stable FX until elections and price controls.”

“Pre-election stimulus, in particular a 55% rise in minimum wages as of January, and the recent acceleration in consumer loan growth are likely to push the monthly inflation momentum higher than the last three months’ average,” Morgan Stanley economists including Alina Slyusarchuk said a report on Friday.

--With assistance from Joel Rinneby.

(Updates with core inflation in third paragraph.)

©2023 Bloomberg L.P.