Oct 24, 2019

Twitter analysts don't see quick rebound as stock dives 20%

, Bloomberg News

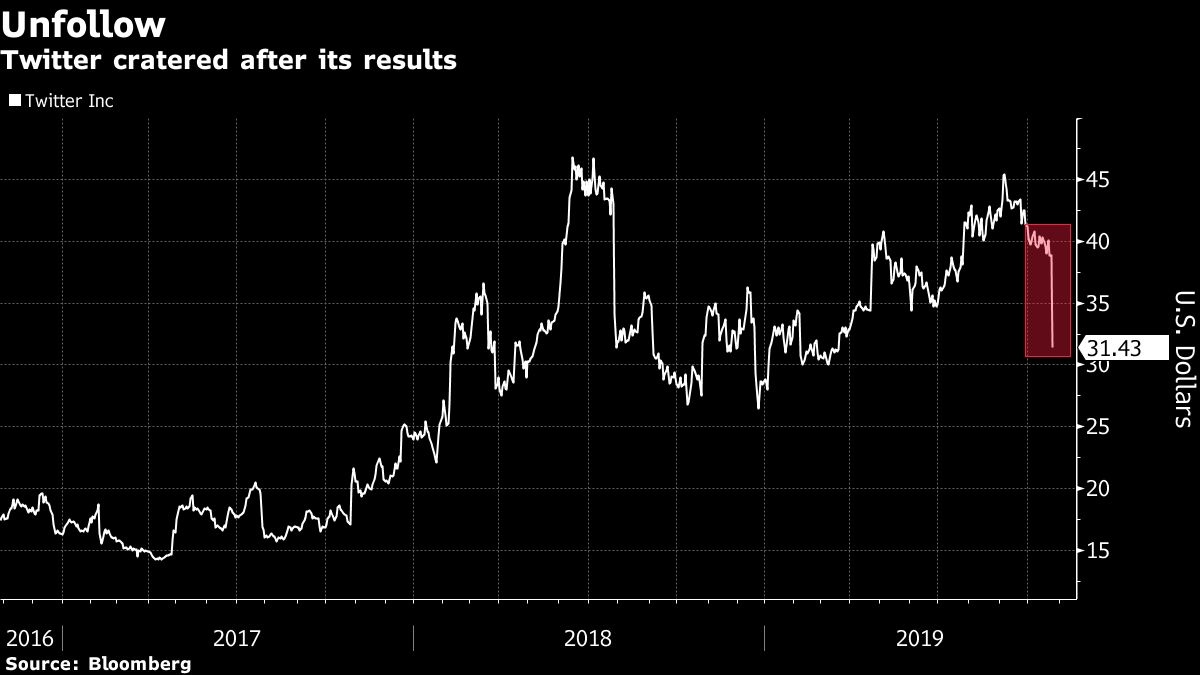

Twitter Inc. shares plummeted on Thursday, after the social-media company reported third-quarter results that came in well below expectations and gave an outlook that was seen as weak.

The stock shed as much as 20 per cent, erasing more than US$4.5 billion from the company’s valuation. Thursday was the biggest one-day percentage loss for the stock since July 2018, and the selloff took shares to their lowest level since March.

The “share price may continue to be under pressure as revenue headwinds will likely persist in the near term,” wrote Hao Yan, an analyst at Citi.

The analyst reaction to report was broadly negative. MKM Partners speculated “whether one can confidently have a view on Twitter’s long-term potential,” describing issues in the quarter as “internal, self-inflicted, and [probably] fixable over the near term.” Analyst Rohit Kulkarni has a neutral rating on the stock.

Loop Capital Markets called the quarter “a disappointing setback,” adding, “We did not foresee the revenue shortfall. We did anticipate better user growth.”

The firm reiterated its buy rating and US$55 price target but wrote that “we do not think the stock will recover quickly,” particularly in a market that has been shunning “longer-duration, higher-risk investments.”

Baird trimmed its price target by US$1 to US$39, calling the results “disappointing.” However, it called Twitter’s user growth “a positive sign of ongoing product improvement,” and added that if platform issues prove transitory, then “today’s pullback could prove to be an opportunity.”