May 7, 2021

U.S. Corporate Bond Spreads Hit Three-Year Low Amid Demand Surge

, Bloomberg News

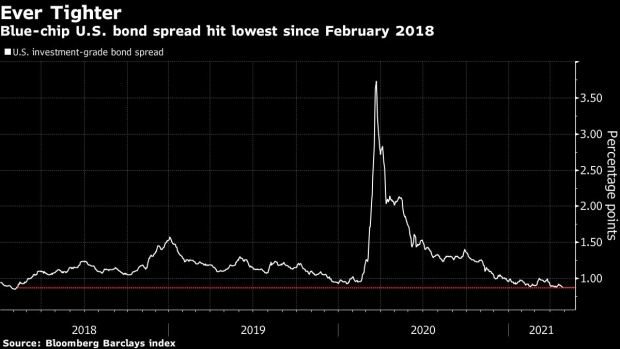

(Bloomberg) -- High-grade U.S. bond spreads hit a more than three-year low on Friday as investors prowling for yield amid easy monetary policies drive demand for corporate debt.

The risk premium on high-grade bonds tightened one basis point to close at 87 basis points, a level reached only a handful of times since the 2008 financial crisis, according to Bloomberg Barclays index data. Even as issuers storm the market with new debt sales, the seemingly insatiable investor demand has so far continued to translate into attractive funding costs for companies.

Investment-grade bonds have posted their best returns since November, logging gains of more than 1% in April amid strong economic projections, following the worst start to a year since 1980. Inflation concerns earlier in the year drove up Treasury yields and caused some debt buyers to grow cautious of duration risks in fixed income.

Bond investors are again racing to find places to park their cash as spreads across the spectrum plummet amid strong corporate earnings, improving economic forecasts and an accelerating Covid-19 vaccine rollout.

Investors have added cash to corporate bond funds all year with inflows reaching $3.85 billion in the week ended May 5, according to Refinitiv Lipper.

Still, new federal tax policies that target corporations and high earners could dim the outlook. Inflation could also pick up, causing a rise in Treasury yields that hits investment-grade debt, which is sensitive to rates moves because of its duration. But it might take more than that to stem the tightening of spreads as foreign buyers add to demand.

©2021 Bloomberg L.P.