Jun 1, 2022

U.S. stocks decline as data show a still-hot economy

, Bloomberg News

Sticking with a barbell investment strategy: Art Hogan

US equities started the month lower after a strong set of data suggested the Federal Reserve has not yet slowed growth enough to tamp down inflation, while JPMorgan Chase & Co.’s Jamie Dimon warned restrictive policies threaten to tip the economy into recession.

The S&P 500 fell 0.8 per cent as data showed an unexpected advance in US manufacturing activity as well as exceptionally high job openings, fueling concern the Fed will need to get more restrictive to slow runaway price gains. Financial firms in the index slid 1.7 per cent after Dimon said private borrowers may be stranded as conditions tighten.

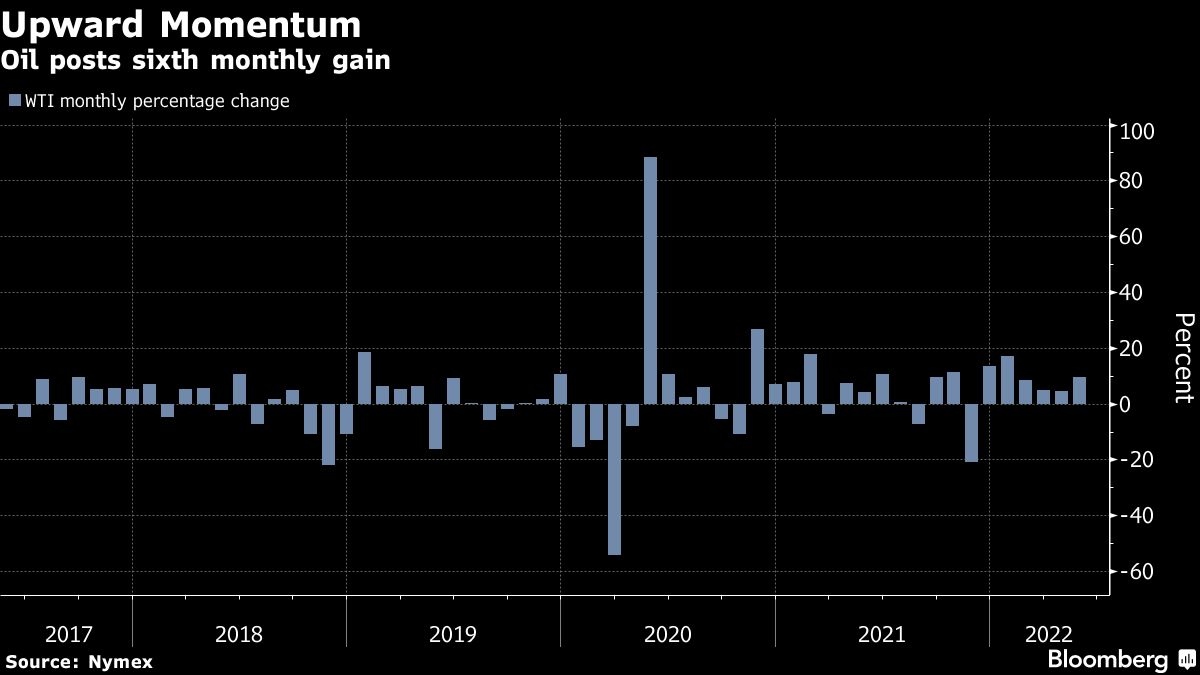

The yield on 10-year Treasuries spiked higher as traders raised bets on the path for rate hikes. Oil rose ahead of an OPEC+ meeting to discuss supply policy. And tech shares outperformed, led by a 10 per cent surge in Salesforce Inc. The business-software giant jumped the most in nearly two years after raising its forecast in a sign demand remains robust.

The strong data landed in a market where investors are on edge over whether the Fed’s tighter policies will induce a recession, a sentiment underscored by Dimon’s comments. The central bank has twice raised rates since March and signaled it will enact two additional 50 basis-point increases at its next meetings.

While some economic data have started to slow, according to the Fed’s Biege Book, others remain robust enough that investors now see the chances growing for a third 50-point increase. St. Louis Fed President James Bullard urged policy makers on Wednesday to raise interest rates aggressively followed by cuts later.

“We now find ourselves in a little bit more no man’s land,” Greg Boutle, US head of equity and derivative strategy at BNP Paribas, said on Bloomberg TV. “We are in this kind of a bear market environment yet we haven’t seen recession manifest in a macro data yet. So we still think there is a path for the US economy to have a soft rather than a hard landing.”

Citigroup Inc. strategists said that after a difficult first five months of 2022, the pain may not be over yet for global equity markets. The prospect of downward revisions to earnings estimates is the latest headwind to face stock investors, already rattled by runaway inflation and the potential impact of central-bank tightening aimed at controlling it, the strategists led by Jamie Fahy wrote in a note.

Among individual stock moves, ChargePoint Holdings Inc. slipped as analysts noted that the EV charging network firm’s margins came under pressure due to rising costs and supply-chain disruption. Delta Air Lines Inc. also fell after raising its revenue outlook but warned it likely won’t grow capacity through the year’s end.

Europe’s Stoxx 600 Index extended declines in the wake of euro-zone figures Tuesday that showed a record jump in consumer prices, strengthening the case for the European Central Bank to lift interest rates. Meanwhile, in the US, Treasury Secretary Janet Yellen gave her most direct admission yet that she made an incorrect call last year in predicting that elevated inflation wouldn’t pose a continuing problem.

“Big picture, the market has priced in an economic slowdown but not a recession,” Ned Davis Research strategists Ed Clissold and Thanh Nguyen said in a note. “The timing and magnitude of any Fed pivot is the biggest factor in determining whether the rally can continue deep into the second half of the year. Another hurdle for the market is that earnings estimates appear vulnerable to further downward revisions.”

Here are some key events to watch this week:

- Cleveland Fed President Loretta Mester discusses the economic outlook Thursday

- US May employment report Friday

- The UN’s Food and Agriculture Organization releases its monthly food price index at a time of maximum concern about global supplies on Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.7 per cent as of 4:01 p.m. New York time

- The Nasdaq 100 fell 0.7 per cent

- The Dow Jones Industrial Average fell 0.5 per cent

- The MSCI World index fell 0.8 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.6 per cent

- The euro fell 0.7 per cent to US$1.0654

- The British pound fell 0.9 per cent to US$1.2485

- The Japanese yen fell 1.2 per cent to 130.18 per dollar

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 2.93 per cent

- Germany’s 10-year yield advanced six basis points to 1.19 per cent

- Britain’s 10-year yield advanced five basis points to 2.16 per cent

Commodities

- West Texas Intermediate crude rose 0.2 per cent to US$114.95 a barrel

- Gold futures rose 0.1 per cent to US$1,850.60 an ounce