Aug 28, 2023

U.S. stocks grind higher at start of busy economic week

, Bloomberg News

BNN Bloomberg's mid-morning market update: Aug. 28, 2023

Stocks rose and bond yields fell at the start of a week full of economic data that will help shape the outlook for Federal Reserve policy.

In a reasonably quiet trading session, the S&P 500 hovered near 4,400. 3M Co. rallied as Bloomberg News reported a tentative agreement to pay over US$ 5.5 billion to resolve lawsuits claiming it sold defective combat earplugs. Nvidia Corp. led gains in megacaps. Auctions of two- and five-year Treasuries drew the highest yields since before the 2008 financial crisis.

Read: ‘Slippery Slope’ Looms Ahead of a Second Bull Run: Surveillance

August’s risk-off mood showed some signs of abating, but the U.S. equity benchmark is still poised for its worst month of 2023 after a higher-for-longer rates narrative took hold. Fed Chair Jerome Powell stuck to the script in his Jackson Hole speech Friday, saying officials are “prepared to raise rates further if appropriate,” while stressing the central bank would “proceed carefully” — guided by economic data.

Traders want to see economic figures that suggest activity is slowing enough to keep further rate hikes at bay, but not too slow to indicate the U.S. is headed for a recession, according to Anthony Saglimbene, chief market strategist at Ameriprise. Given that the earnings season is in the rearview mirror, and the next Fed gathering is weeks away, incoming data will likely take center stage for a while, he added.

“This week is important because it has the chance to either reinforce the ‘soft/no landing’ and ‘disinflation’ pillars of the rally, or potentially undermine them,” said Tom Essaye, founder of The Sevens Report newsletter. “The former will likely result in a reflex rally, while the latter could open up a sharp drop in stocks. We’ll be watching closely.”

Employment growth in the U.S. probably cooled and wage increases moderated, suggesting a further tempering of inflation risks that reduces the urgency for another rate hike. Other labor-market figures are seen showing fewer job openings than a month earlier, indicating supply and demand are coming into better balance. Fed officials will also get a fresh read on their preferred inflation gauge — the personal consumption expenditures price index minus food and energy.

There’s enough ambiguity about the recent strength of jobs, wage, and inflation data to keep the Fed on hold in September, according to Seema Shah, chief global strategist at Principal Asset Management. By November, the economy should be showing clearer signs of softening, she added.

“Our expectation is that Fed policy rates have now peaked,” Shah noted. “Of course, the Fed will need to remain alert to inflation pressures — as long as economic growth is strong, a resurgence in inflation is a risk. As such, the first Fed rate cut will likely only come in late 2Q 2024.”

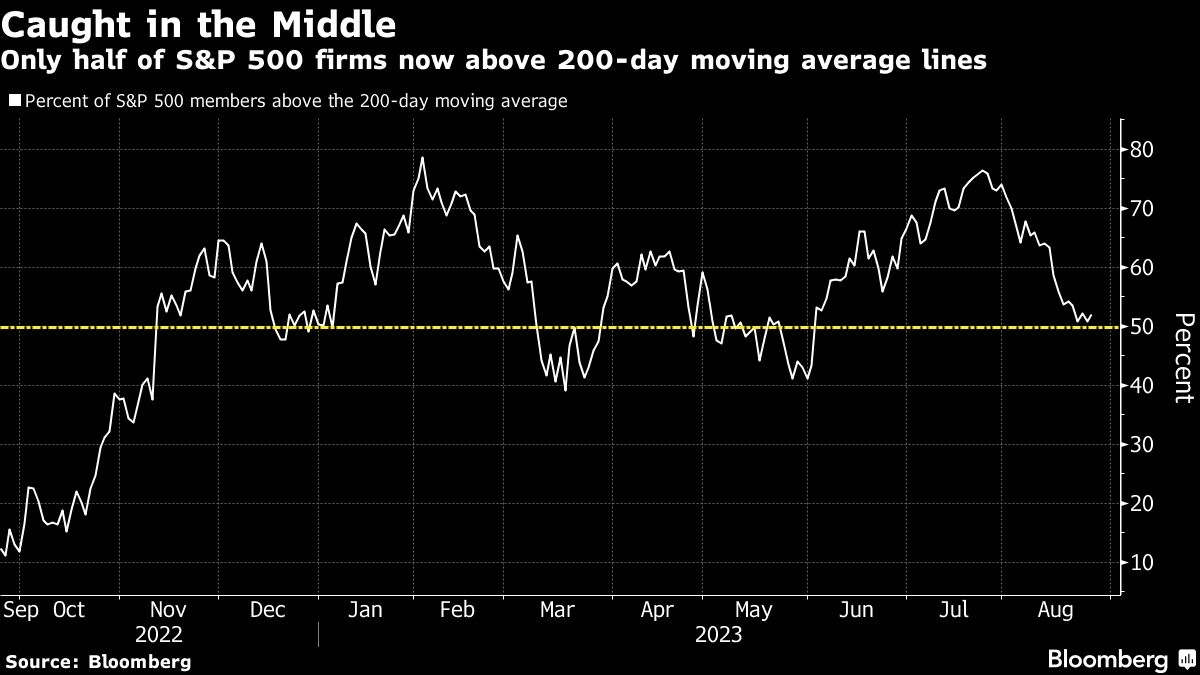

Chart watchers looking for clues about the stock market’s next direction have a few key levels to monitor.

Mark Newton at Fundstrat Global Advisors has his eyes on 4,440 for the S&P 500. That level lies near a 38.2 per cent Fibonacci retracement — and as such it marks a key hurdle for the index to clear in order to continue the rebound. Meantime, the gauge’s companies are now evenly split, with half above and half below their 200-day moving-average lines. That’s a departure from late July, when two-third of the members traded above those levels.

The equity market’s pullback in August was a healthy realignment as sentiment had previously been “overly optimistic” about Fed policy and corporate earnings, according to Rod von Lipsey, managing director at UBS Private Wealth Management.

“Our base case is that most of the stock market’s gains look to be in the books for the year,” he added. “Because of this, bonds are our preferred asset class, since slower economic growth and higher-for-longer rates should be favorable for bond yields, which are currently at very attractive levels.”

Western Asset Management also says bonds are set to outperform due to attractive yields, while JPMorgan Chase & Co. is keeping its bullish bets on fixed income despite Powell’s warning at Jackson Hole Friday. Even fresh Fed hikes won’t deliver bond losses steep enough to outweigh the income from the highest yields since 2007, the bulls argue.

Treasuries will beat U.S. stocks over the next month, according to 58 per cent of respondents in the latest MLIV Pulse survey. Yet history shows a different picture. Looking back 20 years, equities did better than bonds 12 times during the month of September.

In addition to the current allure of Treasury yields, some traders see seasonality as another reason leading to consolidation in the equity market.

Since 1945, the S&P 500 posted the worst average return in September, according to Sam Stovall, chief investment strategist at CFRA. With an only 44 per cent frequency of gains, it was the only month to see the gauge decline more frequently than it rose, he noted.

Corporate Highlights:

- A gauge of U.S.-listed Chinese stocks climbed as the Asian nation took steps to lure investors back to its market.

- American Airlines Group Inc. was ordered to pay a US$ 4.1 million fine, the largest such penalty to date, for allowing aircraft to sit on the ground for three hours or more without giving passengers a chance to exit.

- PG&E Corp. said it will likely have to cut power in some parts of Northern California on Wednesday due to a forecast of high winds and dry conditions.

- Hawaiian Electric Industries Inc. soared after the utility pushed back against a lawsuit filed by Maui County that accused the company of starting the deadly Lahaina fire, suggesting that county’s fire department may be responsible for losing control of the blaze.

- Danaher Corp. said it will acquire Abcam Plc in a deal worth US$ 5.7 billion, beating out rivals in a race to acquire the UK-based maker of supplies for the life-sciences industry whose technologies are used by thousands of researchers.

- CrowdStrike Holdings Inc. fell as Morgan Stanley downgraded the software company to equal-weight from overweight ahead of its results.

- Novocure Ltd. sank after the company said a late-stage trial of its ovarian cancer drug did not meet its primary endpoint of overall survival at the final analysis.

Key events this week:

- U.S. Conference Board consumer confidence, Tuesday

- Eurozone economic confidence, consumer confidence, Wednesday

- U.S. GDP, wholesale inventories, pending home sales, Wednesday

- China manufacturing PMI, non-manufacturing PMI, Thursday

- Japan industrial production, retail sales, Thursday

- Eurozone CPI, unemployment, Thursday

- ECB publishes account of July monetary policy meeting, Thursday

- U.S. personal spending and income, initial jobless claims, Thursday

- China Caixin manufacturing PMI, Friday

- Eurozone S&P Global Eurozone Manufacturing PMI, Friday

- South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

- Boston Fed President Susan Collins speaks at virtual event, Friday.

- U.S. unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.6 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.7 per cent

- The Dow Jones Industrial Average rose 0.6 per cent

- The MSCI World index rose 0.8 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2 per cent to US$ 1.0818

- The British pound rose 0.2 per cent to US$ 1.2604

- The Japanese yen was little changed at 146.51 per dollar

Cryptocurrencies

- Bitcoin fell 0.4 per cent to US$ 25,977.81

- Ether fell 0.5 per cent to US$ 1,645.73

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.20 per cent

- Germany’s 10-year yield was little changed at 2.56 per cent

- Britain’s 10-year yield advanced two basis points to 4.44 per cent

Commodities

- West Texas Intermediate crude rose 0.4 per cent to US$ 80.12 a barrel

- Gold futures rose 0.4 per cent to US$ 1,947.70 an ounce