Mar 23, 2023

UK Consumers Downbeat on Finances Despite Improving Outlook

, Bloomberg News

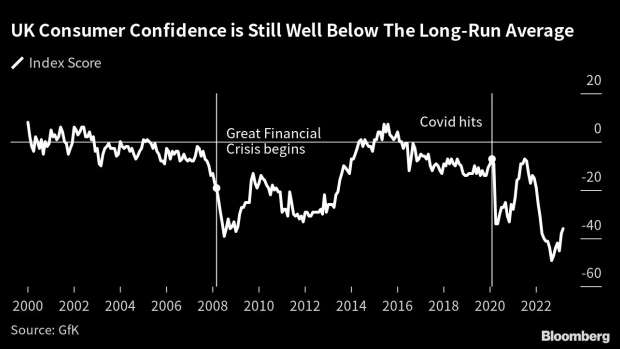

(Bloomberg) -- UK shoppers are expecting their personal finances to deteriorate further over the next year, in a sign that sticky inflation and continuing interest-rate hikes are weighing on sentiment.

The closely watched Consumer Confidence Barometer from GfK improved slightly on an overall basis in March, as households grew less gloomy about the general economic situation.

But this masked growing pessimism surrounding their own budgets over the next 12 months. Although consumer sentiment has improved from last September’s lows, it remains weaker than a year ago.

The data may provide some hope to the Bank of England, which pushed ahead with an 11th consecutive rate hike yesterday, that its monetary tightening is finally beginning to filter through to the real economy.

But it will be concerning for Prime Minister Rishi Sunak, who has vowed to jump-start the UK’s stagnant economy and fuel growth to bring greater prosperity.

“A small improvement in the overall index score this month masks continuing concerns among consumers about their personal financial situation,” said GfK’s client strategy director Joe Staton.

This measure “best reflects the financial pulse of the nation and it remains weak,” he said.

“Forecasts that headline inflation will fall this year have proved premature, given Wednesday’s announcement of an unexpected increase. Wages are not keeping up with rising prices and the cost-of-living crisis remains a stark reality for most.”

Falling consumer confidence was also picked up in the latest report from the BOE’s network of agents who communicate with businesses around the country, published on Thursday.

Agents said consumers were “switching down to the discount chains” while clothing retailers were “having increasingly to resort to discounting.”

Rate Hike

Inflation readings for February, published on Wednesday, surprised markets and economists who had been expecting a fall from 10.1% down into single digits for the first time since August 2022. Instead, it climbed to 10.4%.

This contributed to the BOE’s decision to hike interest rates by another 25 basis points to 4.25% on Thursday, overriding concerns that a rapid tightening in monetary policy was contributing to turmoil in the banking system.

But the Bank was more optimistic than in February about the outlook for household finances — it now expects real incomes to remain flat this year, rather than falling.

Retail sales data, due to be released this morning, are also expected to show sales in February edging up by 0.2% on a month earlier.

Charles Bean, a former member of the Bank’s rate-setting committee, said earlier on Thursday that he thought real incomes would need to fall by around 5% to adjust for the shocks stemming from the war in Ukraine.

Read more:

- BOE No Longer Expects UK Living Standards to Fall This Year

- Bailey Says SVB UK Drew Regulatory Scrutiny Before Collapse (1)

- Charles Bean Says UK Real Incomes Need to Fall 5% Due to Shocks

- Former Goldman Economist Blames UK Fiscal Rules for Weak Growth

©2023 Bloomberg L.P.