Sep 21, 2022

UK Government Borrowing Swells Ahead of Truss Tax Cut Program

, Bloomberg News

(Bloomberg) --

The UK government borrowed almost twice as much as officially forecast in August, raising questions about the sustainability of the public finances even before Prime Minister Liz Truss’s plans for a multi-billion pound giveaway in a mini-budget on Friday.

The budget deficit last month was £11.8 billion ($13.4 billion), £5.8 billion more than the Office for Budget Responsibility expected in March. Runaway inflation drove debt-interest costs to £8.2 billion, the highest for any August on record, the Office for National Statistics said. Monthly borrowing also overshot market forecasts by roughly 50%.

The deterioration in the deficit comes as Truss prepares a massive support package for households facing rising energy costs and a growth plan that will see cuts to payroll and corporation taxes. The plans to be unveiled this week are expected to reveal that the government will borrow over £200 billion more in the next two years.

Chancellor of the Exchequer Kwasi Kwarteng said: “I have pledged to get debt down in the medium term. However, in the face of a major economic shock, it is absolutely right that the government takes action now to help families and businesses, just as we did during the pandemic.”

Kwarteng has come under attack because his mini-budget will not be accompanied by a formal costing from the OBR. Responding to the August public finance figures, the OBR said the energy bill bailout and other measures will mean “borrowing can be expected to overshoot our March forecast significantly in the second half of 2022-23.”

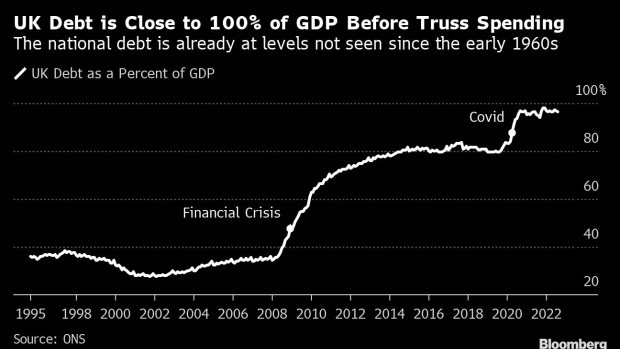

The national debt is already at levels not seen since the early 1960s, at £2.43 trillion or 96.6% of GDP. Inflation is adding to the burden, as about a quarter of government bonds are linked to the retail prices index. Of the £8.2 billion of in debt costs in August, £4.7 billion reflected the impact of the RPI, the ONS said.

Truss has promised over £30 billion of tax giveaways in a bid to turbocharge the economy, and earlier this month pledged additional support for households and businesses struggling with soaring gas and electricity costs.

Kwarteng is due to set out the details on Friday, with Bloomberg Economics predicting the cost will put debt on an “unsustainable path.”

What Bloomberg Economics Says ...

“The key elements of Chancellor of the Exchequer Kwasi Kwarteng’s Sept. 23 fiscal event will be tax cuts and more detail on energy crisis support. The government also looks set to pivot from fiscal conservatism toward efforts to stimulate long-run economic growth. With tax cuts alone unlikely to deliver that goal, our concern is that the package will keep inflation above 2% for longer and shift the public finances onto an unsustainable path.”

--Dan Hanson, Bloomberg Economics. Click for the PREVIEW.

The government finances were rescued by a series of past revisions which lowered borrowing in the financial year to date by more than £8 billion, leaving borrowing in line with OBR projections at £58.2 billion.

The figures will fuel criticism that Truss is putting the public finances at risk and stoking inflation. In his mini-budget on Friday, Kwarteng is expected to reverse a payroll tax increase that took effect in April and cancel a planned rise in corporation tax set to take place in 2023. Both were pledges made by Truss during her campaign to succeed Boris Johnson.

UK borrowing bonds have underperformed peers recently, with investors demanding 3.25% of yield to hold 10-year gilts -- around the highest in 11 years.

The OBR had forecast the deficit, which ballooned to more than 14% during the coronavirus pandemic, would fall to below 4% of GDP this year. However, it now seems certain to be higher than last year.

The prime minister and her chancellor argue that lower taxes will lift economic growth and generate tax revenue. That argument was called into question this week by the IPPR think tank, which pointed out that Britain has the lowest level of business investment in the Group of Seven, despite a sharp fall in corporation tax over the last 15 years.

“If Kwarteng manages to spur growth, our analysis shows the public finances on a stable footing,” Dan Hanson of Bloomberg Economics said in a report Tuesday. “But if we are right that the government’s measures will not sustainably alter the trajectory of the economy, stabilizing the debt burden would require a fiscal tightening of a little over 1% a year.”

Read more:

- Liz Truss Plans to Cut UK Stamp Duty Tax, The Times Reports

- Truss Says UK Must Examine Tax Rates as She Goes For Growth

(Adds OBR response)

©2022 Bloomberg L.P.