Aug 8, 2022

UniCredit’s Top Investment Bankers Hunt for Gains Amid Turmoil

, Bloomberg News

(Bloomberg) -- UniCredit SpA’s top corporate and investment bankers are betting on surging demand for risk products in the most volatile market in a decade, and taking deal-making business from rivals to help meet ambitious revenue targets set down by Chief Executive Officer Andrea Orcel.

In a joint interview, Richard Burton, head of the unit that includes all the corporate and investment banking activity, and advisory head Sam Kendall said they’re seeking to win market share from local and international rivals in M&A and capital markets. They see easier profits from hedging and other risk products clients are demanding to navigate the turmoil unleashed by the invasion of Ukraine and surging inflation.

“In a second half likely dominated by volatility and uncertainty, we can over-perform in transactions and client risk management,” according to Burton, while “in the more challenging segments of capital markets and M&A, we expect to further erode market share from peers,” said Kendall.

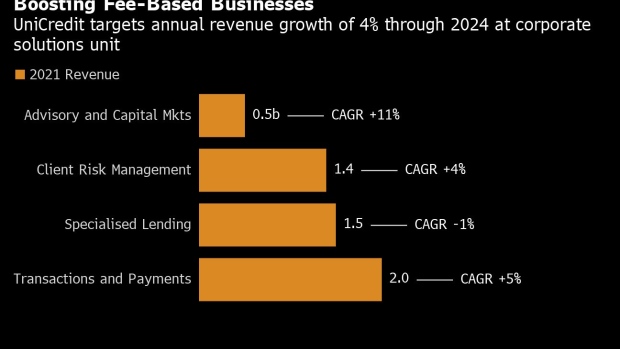

Orcel, who gained a reputation as a top dealmaker while head of UBS Group AG’s investment bank, is now reshaping UniCredit’s corporate and investment bank. He’s enlarged Burton’s duties and has hired ex-UBS Group AG colleague Kendall to focus on more medium-sized corporate clients, with the aim of boosting annual revenue at the corporate solutions unit by 4% through 2024.

In the second quarter, the business generated 1.5 billion euros ($1.5 billion) in revenue, or a third of the total. The unit offers a range of transaction services, structured finance, capital markets and investment products to its 1 million clients through more then 3,000 employees. Revenues were up 16% year on year, driven by a 25% increase in client risk management income that more than offset an 11% decline in advisory and capital markets’ revenue.

“It’s our intention to meet the targets we set ourselves in corporate solutions,” said Burton. “Now, the sub mix might change slightly because the environment has changed, but the levers of this plan are mostly under management control.”

Read More: UniCredit Cheers Investors With $18 Billion in Planned Returns

In UniCredit’s overall strategy outlined in December, Italy’s second-biggest bank shifted the focus on client needs in each of the 13 countries where it operates, bringing all corporate and individual offers under the same control. The coverage of clients needs has been split among countries where they are based, while the products are managed at the group level by Burton’s team.

Since then, the list of pressure points has quickly increased, from fears surrounding Russia’s invasion of Ukraine and the potential use of gas deliveries as a geopolitical weapon, to surging inflation, interest-rate increases and recession.

“When we put together the plan at the beginning of year, we might have thought there were going to be a lot of IPOs,” said Burton. “Now, we’re doing more in private capital markets. Similarly, we might have thought certain industries were going to grow, but the picture has changed.”

As part of the bank’s new strategy Orcel hired Kendall in September to oversee industry coverage, advisory, as well as public and private equity and debt capital markets. Since his hiring, Kendall’s task has become harder as global deal activity collapsed and the trading business struggled to keep pace with Wall Street peers.

We have has readdressed our focus to meet the new needs of clients,” said Kendall. “Business plans are being adjusted but strategies are not changing.”

Read More: UniCredit Hires Ex-UBS Top U.S. Investment Banker Kendall

In a shrinking business, Kendal is focusing on relative performance to peers and expects to gain additional share in the second half, in each of the single segments of advisory and capital markets. In advisory and capital markets, the bank’s market share by fees -- which includes M&A, ECM, DCM and Loan Syndication-- increased to 6.2% in the second quarter from 4.7% a year earlier.

“The international banks don’t know our clients as well as we do, particularly in the mid-market segment,” said Kendall. “We expect to take market share from local banks, as well as boutiques and investment firms, because we’re more international than any local bank. And we’re more local than any international bank,” added Burton.

©2022 Bloomberg L.P.