Mar 30, 2023

US Favors Raising World Bank's Risk Tolerance for More Aggressive Lending

, Bloomberg News

(Bloomberg) -- The Biden administration favors potentially increasing the World Bank’s risk tolerance in the future more than the institution’s shareholders have decided for now, a move that could enable the lender to provide billions more for global challenges including climate change.

The board of the International Bank for Reconstruction and Development, the World Bank arm that lends to middle-income and creditworthy low-income nations, backs a plan to lower its minimum equity-to-loan ratio to 19% from the current 20%, according to people familiar with the matter, who asked not to be identified because they don’t have permission to speak publicly. That would be the first change to the key metric in a decade and boost lending capacity by $4 billion a year.

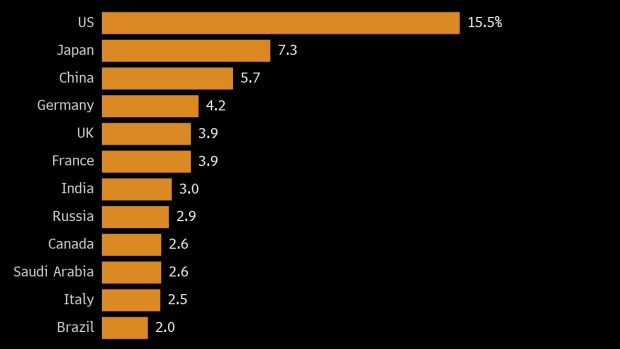

The US — the World Bank’s biggest shareholder — favors an exploration of lowering it again to 18% down the line if analytics merit, according to a US official. That would double the amount of additional funds available to $8 billion.

The board considered making that larger cut now, but settled on the smaller reduction after some borrowing nations expressed concern that a larger move could increase the cost of the World Bank’s own financing in the bond market and therefore the interest rates that it would need to charge for loans, one of the people said.

The US sees consensus as important in the process and is responsibly pushing for ambition in advances at the institution, and for changes to be made on a rolling basis, the US official said.

World Bank governors are poised to review the plan at the lender’s Spring Meetings next month. A spokesman for the Washington-based anti-poverty lender declined to comment on shareholder discussions.

The issue shows the challenges for the institution as it seeks to expand lending to meet the climate finance needs of the developing world, while continuing to provide low-interest loans for traditional issues like health, education and infrastructure.

Outgoing President David Malpass has urged steps to ease the flow of private capital to help provide $2.4 trillion in annual funding required to address climate, conflict and pandemic costs over the next seven years. Environmental groups have called for making bigger changes to the institution’s lending model.

Failing to eventually lower the equity-to-lending ratio below 19% would be “a missed opportunity to put a significant amount of more climate, poverty alleviation, pandemic response on the table, from money the World Bank already has,” said Jake Schmidt, the senior strategic director for international climate at the Natural Resources Defense Council.

Malpass and former Mastercard Inc. Chief Executive Officer Ajay Banga, who Biden has nominated to replace him, both say that any changes to the institution must preserve its AAA credit rating, which allows it to borrow and lend cheaply to poorer countries.

--With assistance from Viktoria Dendrinou.

©2023 Bloomberg L.P.