Nov 4, 2022

US Labor Market Cools, Barely, Leaving Fed’s Job Far From Done

, Bloomberg News

(Bloomberg) -- Tiny cracks are beginning to emerge in the US labor market’s resilience to higher interest rates and surging prices, but plenty of strength remains to keep Federal Reserve officials focused on stamping out inflation.

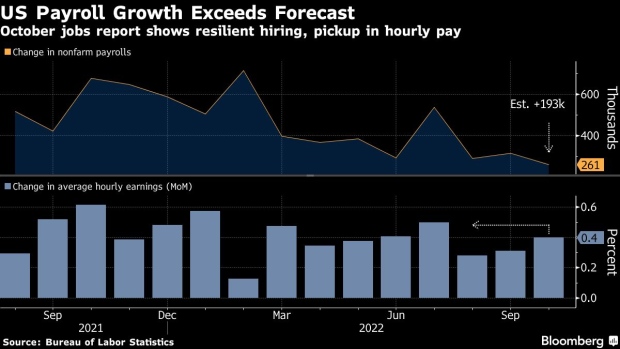

Businesses boosted hiring in October by 261,000, which was more than expected, and average hourly earnings accelerated from September, according to a Labor Department report Friday.

But the jobless rate rose to 3.7% from a more than five-decade low, the gain in payrolls was the smallest since the end of 2020 and the annual advance in earnings dipped below 5% for the first time since last year.

The broad takeaway is a job market that’s cooling albeit not very quickly. That lines up with Jerome Powell’s characterization earlier this week, when the Fed chair acknowledged conditions haven’t softened yet in an “obvious” way and said the central bank is eyeing a higher peak interest rate than it was two months ago.

Fed officials have repeatedly emphasized that in order to meet their 2% inflation goal, they need to bring labor supply and demand more into balance. Yet, the report suggests robust demand for labor even with a flurry of interest-rate hikes, an uncertain economic outlook and reports of layoffs.

“It’s still pretty strong,” said Sarah House, senior economist at Wells Fargo & Co. Fed officials “still have a tremendous amount of work to do in terms of taming inflationary pressures coming from the labor market.”

At the same time, there are “hints that labor demand is cooling and taking hiring down with it,” House said.

Treasury yields largely erased gains following the report, while the S&P 500 index rose and the dollar fell. Traders are still leaning toward a downshift in the Fed’s pace of tightening to 50 basis points in December, though they also see rates headed above 5% from the current target range of 3.75% to 4%, following a fourth straight 75 basis-point hike this week.

Richmond Fed President Thomas Barkin said on CNBC Friday that a strong labor market and stubborn inflation means the central bank may need to raise rates above 5%, though it may slow its pace of increases. Boston Fed chief Susan Collins said in a speech that it’s “premature to signal how high rates should go.”

The figures on Friday also represent the last hallmark economic report ahead of the midterm elections next week.

The economy has consistently ranked among voters’ top priorities this cycle and the persistent inflation has hurt President Joe Biden’s approval ratings and given Republicans hope for taking control control of the House, Senate or both.

Friday’s data showed job gains were relatively broad based, with categories like health care, professional and business services and manufacturing posting solid increases.

Hourly Earnings

Average hourly earnings rose 0.4% from the prior month and were up 4.7% from a year earlier. While the annual increase was a step down from the 5% growth in September, earnings are still growing at roughly double the average pace during the 2009-2020 expansion.

Businesses are finding some relief from declines over the past several months in many commodities including fuels and labor cost pressures have leveled off, yet wage pressures remain elevated. Apple Inc. Chief Executive Officer Tim Cook said on the iPhone maker’s recent earnings call that “there’s clearly wage inflation,” and other companies see that as persisting.

Sectors like tech and real estate, which are more sensitive to interest-rate hikes, are already feeling the pinch of tighter Fed policy though it will take time for other industries to feel the impact.

Apple has put on a hold on hiring for many positions outside of research and development. Other technology companies including Amazon.com Inc. are either freezing hiring or, as in the case of Lyft Inc., slashing payrolls outright.

The jobs report showed the labor force participation rate -- the share of the population that is working or looking for work -- ticked lower to 62.2%, and the rate for workers ages 25 to 54 dropped to a three-month low.

“We’re seeing just the glimmers of what the Fed hopes to see in terms of their tightening this year, but it’s going to take some time,” Jeffrey Rosenberg, a portfolio manager at BlackRock Inc., said on Bloomberg Television. “The economy is not responding to the Fed’s tightening and so they’ve got a lot more work to do.”

--With assistance from Reade Pickert and Molly Smith.

©2022 Bloomberg L.P.