Dec 13, 2022

Wall Street Celebrates CPI’s ‘First Really Meaningful Beat’

, Bloomberg News

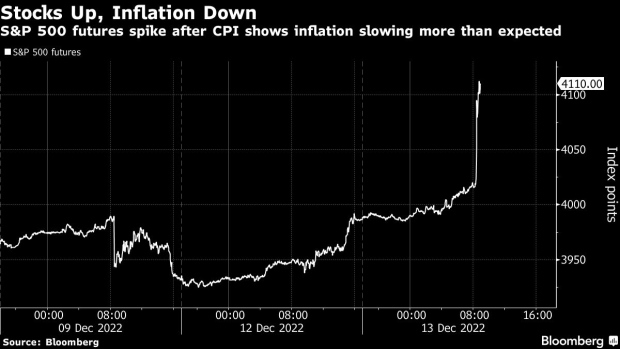

(Bloomberg) -- Wall Street’s growing optimism that the Federal Reserve will be able to ease up its tightening later this week was confirmed by inflation data for November that showed prices rose less than forecast.. The US consumer price index increased 0.1% from the prior month and was up 7.1% from a year earlier. Core CPI posted the smallest monthly advanced in more than a year.

Stock futures on the S&P 500 jumped over 3%, while yields on 2-year Treasury bonds sank more than 20 basis points after the release.

“This was an important piece of the story of rate hikes working. First really meaningful beat,” said Lindsay Rosner, multi-sector portfolio manager at PGIM Fixed Income.

Here’s what other analysts were saying:

Art Hogan, chief market strategist at B. Riley Wealth Management:

“This is the good news that is actual good news for markets.”

“It will be too soon for the Fed to change their summary economic projections or the ‘dot plot’ for Wednesdays meeting, but it should put a lid on how high the terminal rate goes.”

Brent Donnelly, president of Spectra Markets:

“The number clearly shows the trend lower in inflation but the more important thing for the Fed is where inflation bottoms. Therefore, while the direction of travel is encouraging, the Fed will not want to make the mistake it made in the 1970s and take its foot off the brake too early.”

Bryce Doty, Senior Portfolio Manager at Sit Investment Associates:

“Bring on the relief rally as the Fed is now much closer to feeling they have succeeded in reigning in inflation (regardless of how much of this new trend is due to the rapid rate increases in fed funds).”

Matthew Luzzetti, chief US economist at Deutsche Bank AG, on Bloomberg Television:

“Obviously [the Fed] can step down to 50 basis points. I really do think they want to step down to 25 basis points as quickly as they can, so data of this nature makes them likely to do that at the February meeting if we get another data point like this.”

Esty Dwek, chief investment officer at Flowbank SA:

“We’re probably soon going to see the Fed shift to ‘higher for longer’ as a focus instead of ‘still higher,’ but for now, markets can be happy and hope the labor market starts to cool a bit more to confirm the Fed slowdown.”

Charles-Henry Monchau, chief investment officer at Banque Syz:

“The biggest drivers of the lower print were energy costs, medical care and used cars. But the very good news is that the softer read is widespread.”

James Athey, investment director at Aberdeen Asset Management:

“The narrative that the only thing holding back risk markets is the Fed, and therefore by extension high inflation, is certainly appealing. Unfortunately, it fails to recognize that tight monetary policy has only just begun weighing on corporate earnings. As the full effects of the Fed’s aggressive actions this year play out next year it seems inevitable that we will see a significant repricing lower in EPS forecasts and thus the broad market.”

Chris Zaccarelli, chief investment officer at Independent Advisor Alliance:

“The real story is going to be 6 to 9 months from now. Will inflation be down to 3% or 4% or will it remain well above 2% for a long time to come? No one is expecting the Fed’s next rate move to be higher after a long pause and that is something that would roil the markets, if it were to happen.”

April LaRusse, head of investment specialists at Insight Investments:

“The slightly softer CPI numbers are almost entirely driven by the retracement we have seen in food and energy prices. With global growth decelerating it is not a surprise to see these components rolling over first. The key thing to watch is core service inflation which has yet to moderate. Without services and wages under control we are not out of the woods yet on inflationary risks.”

--With assistance from Liz Capo McCormick, Vivianne Rodrigues, Farah Elbahrawy and Sagarika Jaisinghani.

(Adds comments from Zaccarelli, Monchau)

©2022 Bloomberg L.P.