Apr 14, 2023

Wall Street Forecasts Big Rate Hikes in Turkey After Elections

, Bloomberg News

(Bloomberg) -- Wall Street’s biggest banks aren’t waiting for the outcome of Turkey’s cliffhanger election next month to call what it means for the country’s monetary policy and almost unanimously forecast that interest rates will return to levels higher than reached after the 2018 currency crash.

Analysts at Citigroup Inc. now expect Turkey’s key rate to end next quarter at 40%. For Bank of America Corp., the benchmark will peak at 50% before a slight decline in the final three months of the year.

It’s a view broadly shared by the market, with the derivatives used to bet on future borrowing costs also showing expectations for much higher rates after the ballot. The median third-quarter forecast of economists surveyed by Bloomberg has now shifted from 10% in February to 25.5% — compared with the current 8.5%.

“A stronger adjustment bringing the policy rate to about 40% or even higher may be a more prudent course of action,” Citi economists Ilker Domac and Gultekin Isiklar said in a report this week.

The massive dollop of monetary tightening assumed by the global banks signals economics is set to prevail over politics no matter the result of the toughest campaign of President Recep Tayyip Erdogan’s two-decade rule.

What Bloomberg Economics Says...

“We see a return to more orthodox policies, regardless of the elections outcome. Erdogan’s economic model aimed to deliver booming investment, current account surplus, stronger lira, and sustained price stability. Instead, the model failed on all four targets.”

— Selva Bahar Baziki, economist. Click here to read more.

An opposition alliance that’s contesting the election has promised a return to orthodox monetary policies and an “autonomous” central bank if elected. Currently, Erdogan has the power to directly appoint and fire the central bank governor and monetary policy committee members.

Should the unconventional policies championed by Erdogan come under scrutiny, the path back to the mainstream will likely be longer and costlier than had the central bank acted earlier in the face of one of the world’s biggest inflation crises last year.

Relying instead on fringe measures while pushing official borrowing costs far below inflation, Turkey has fallen short of reversing its deep current-account deficit or smothering price pressures.

An emergency savings program and backdoor interventions by the central bank have kept the Turkish currency on a leash, buying time but only at a steep price to the budget and reserves.

‘Painful Adjustment’

“We all know the current policy path is unsustainable,” said Viktor Szabo, an investment director at abrdn in London.

Wharton Professor Is Waiting in the Wings to Undo Erdogan Legacy

“And while the opposition has a sensible macro program, it will be a painful adjustment as it would require crashing the economy first to bring down inflation,” Szabo said. “To put it another way, Turkey has been managed into a deep hole, and it will be painful to climb out of it.”

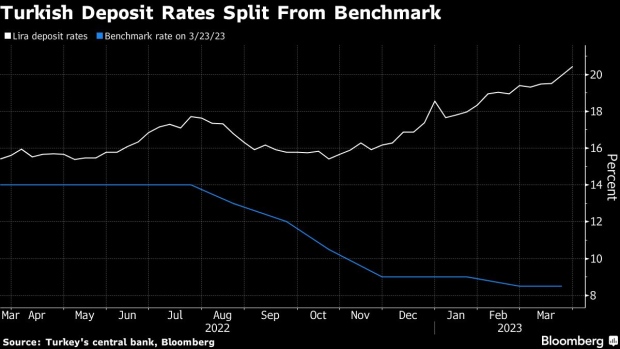

Parts of the economy are already functioning largely in disconnect from official policy. Deposit rates are at the highest in four years and their differential with the central bank’s benchmark is the widest in a decade.

Erdogan has clung to what he calls his “New Economy Model,” a program that prioritizes exports and cheap loans, abandoning conventional policies in favor of measures such as ultra-low interest rates.

The central bank hasn’t raised its key rate for two years even as inflation soared past 85% in 2022. Instead, it more than halved the benchmark since mid-2021 to bring it into into single digits.

Policymakers will next review rates on April 27, with Bloomberg Economics expecting one final cut before the May vote.

Citi Sees Up to $50 Billion Inflow to Turkish Assets After Vote

The view that Turkey is near an abrupt turn away from economic unorthodoxy has plenty of skeptics at home. For Haluk Burumcekci, an independent economist in Istanbul, “an interest rate of 50% will have severely negative consequences on economic activity, employment and on the loan market.”

Rates can go up to 30%, he said, alongside a commitment to “strong monetary policy and inflation targeting.” But Burumcekci believes international banks are being overly alarmist in trying to shape expectations to their own advantage.

“Foreign investors want to make more revenue through high interest rates in the uncertain atmosphere — with the minimum risk in the shortest time possible,” he said.

Path Forward

Though a win by the opposition will likely represent a more decisive break with Erdogan’s legacy, signs abound that policy gears would shift even if the ruling AK Party hangs on.

Erdogan last week said his market-friendly former finance minister, Mehmet Simsek, is leading an overhaul of economic policy without taking on an official role.

Members of the opposition bloc, which includes technocrats and former economy aides from Erdogan’s former administrations, have said Turkey would return to mainstream economics if they’re elected to power.

“All indicators point to a need to rebalance the economy,” BofA economists including Zumrut Imamoglu said in a report. “Regardless of the outcome, we see a weaker lira and tightening economic conditions to address imbalances.”

©2023 Bloomberg L.P.