May 2, 2023

Weak Yen Pushes Japan Inflation Expectations to Four-Month High

, Bloomberg News

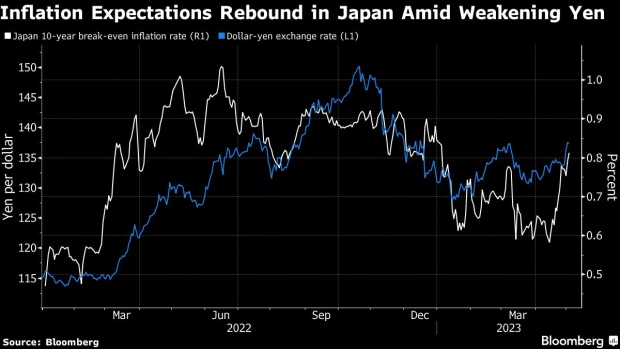

(Bloomberg) -- A gauge of inflation expectations in Japan climbed to a four-month high as renewed yen weakness risks boosting import prices, keeping speculation alive that the central bank may have to reduce monetary stimulus.

The 10-year break-even inflation rate, which is derived from inflation-indexed government bonds, rose to 0.82% on Tuesday, the highest since early January. The yen has weakened about 3% since Friday when the Bank of Japan kept its ultra-accommodative policy unchanged in its first decision under new governor Kazuo Ueda.

“Yen weakness is accelerating, which threatens to raise import prices and fan dissatisfaction among the public,” said Keisuke Tsuruta, a bond strategist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo. “That will eventually lead to renewed speculation that the BOJ will have to adjust policy.”

Data last week showed inflation in Tokyo unexpectedly gained renewed upward momentum, despite government measures to curb utility prices, pointing to a stronger-than-thought underlying price trend. Consumer prices excluding fresh food climbed 3.5% last month.

The BOJ forecasts inflation will slow to 1.6% in the fiscal year from April 2025, which falls short of the central bank’s 2% target and is seen as a reason for Ueda to avoid steering toward policy normalization.

Because the break-even rate is computed by subtracting yields on inflation-linked notes from those on nominal debt, lower yields on the latter lead to a higher rate.

“It looks like some asset managers are buying Japan’s inflation-indexed notes due to demand-supply reasons,” said Shoki Omori, chief desk strategist at Mizuho Securities Co. in Tokyo. Securities due in 2028, 2029 and 2032 are “cheap,” he said.

(Adds strategist comment in last paragraph.)

©2023 Bloomberg L.P.