Sep 24, 2022

Who Wins Most From Kwarteng’s Tax Bonanza?

, Bloomberg News

(Bloomberg) --

Wealthy men living in London and the south of England stand to gain most from the sweeping tax cuts unveiled by Chancellor of the Exchequer Kwasi Kwarteng. These three charts show how.

Kwarteng said a cut in the basic rate of income tax will now take effect in April -- a year earlier than planned. Three quarters of those who don’t earn enough to pay income tax are women, according to the Women’s Budget Group.

It’s a similar story when it comes to abolishing the top 45% tax rate, charged on incomes above £150,000 ($164,000). Around 80% of those affected are men. The decision is projected to cost the exchequer around £2 billion.

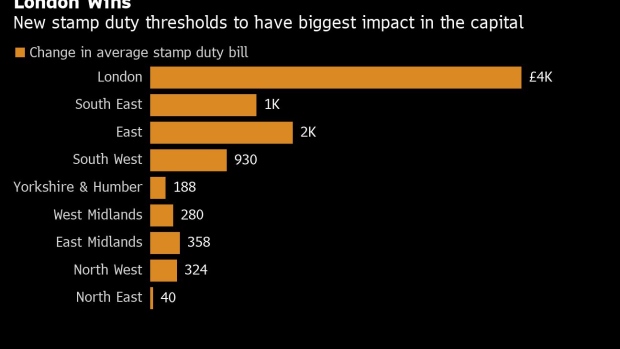

Londoners are the big beneficiaries from the decision to double the threshold for paying stamp duty, a tax on homebuying. That’s because house prices in the capital are twice as high as the national average at more than £540,000, according to Land Registry data. Almost half that amount is now tax free, with the relief for first-time buyers even more generous.

All told, the tax giveaways announced Friday are costing the exchequer around £40 billion a year. Almost half will go to the richest 5% of the population, according to the Resolution Foundation.

There are also regional differences with households in London and the South East set to gain three times as much on average as those in the North through tax cuts -- or £1,600 compared with £500 -- according to the think tank’s overnight analysis.

The Resolution Foundation said the number of people living in absolute poverty is on track to rise by 2.3 million, including 700,000 children.

Its chief executive, Torsten Bell, said the backdrop to yesterday’s fiscal statement was an ongoing cost-of-living crisis that will mean “virtually all households getting poorer next year as Britain grapples with high inflation and rising interest rates.”

(Corrects 3rd chart to remove incorrect figures. Updates with regional analysis from Resolution in sixth paragraph.)

©2022 Bloomberg L.P.