Feb 29, 2024

Xi’s One-Man Rule Over China’s Economy Is Spurring Unrest

, Bloomberg News

(Bloomberg) -- Xi Jinping’s consolidation of power has cleared the path for him to break China’s cycle of debt-driven growth and put the economy on a more sustainable footing. But there’s a big problem: He’s failing to convince the nation that’s a good idea.

As the world’s second-biggest economy undergoes a prolonged slowdown, Xi’s move to shun the old playbook of unleashing broad stimulus is spurring discontent. The China Dissent Monitor, a project of US-based Freedom House that collects information on protests, says economic demonstrations have remained elevated since August, with many focused on labor disputes and a real estate crisis that’s cutting into household wealth.

Thousands of angry retail investors last month flooded the US Embassy’s Weibo page with criticism of the government’s handling of the economy in the midst of a $7 trillion stock rout. Elsewhere on the platform some even insinuated that only a change in the top leadership would spur markets — comments that managed to skirt censors before they were eventually taken down.

Compounding the problems is a broad drop in wages among civil servants who have seen bonuses slashed in recent years as indebted local governments struggle to earn enough revenue. That risks disenfranchising the vast bureaucracy charged with implementing Xi’s vision on the ground.

“As long as my income was decent, I didn’t complain,” said Zhou, a mid-level policeman in a southwestern city who asked to be identified by only his surname, adding that cuts have reduced his bonus by 30% from before the pandemic. “But now the economy is in bad shape, the leadership needs to show us some hope.”

While the growing angst doesn’t pose an immediate threat to Xi, who has amassed more power than any Chinese leader since Mao Zedong, broader discontent threatens to exacerbate weakened confidence as consumer prices drop at the fastest pace since the global financial crisis. The domestic strife comes as foreign investors turn away from China, with direct overseas investment in 2023 slumping to a 30-year low.

At the same time, there are fewer checks on Xi’s policymaking. The Chinese leader has upended Communist Party norms since consolidating power and installing a coterie of loyalists in 2022, marking a shift from the more collective decision-making that helped propel China’s economic rise. That is also making Xi more of a target as his push to deleverage the property sector leads to a slowdown that’s starting to impact the wider population.

Read More About China’s Economy:

- Xi’s Solution for China’s Economy Risks Triggering New Trade War

- Xi’s Mysterious Economic Slogan Adds to Investor Confusion

- Xi Can’t Use 2015 Playbook to Calm China Markets, Investors Say

- China’s Faith in All-Powerful Xi Shaken by Chaos of Covid Pivot

Despite the challenges, the leadership in Beijing appears broadly confident in its plan to reorient the economy, said Yuen Yuen Ang, a professor of China’s political economy at Johns Hopkins University. The danger for Xi is that the “fallout of the decline of the old growth model might be so great it prevents him from moving into the new growth model,” she added. “The big question is, can you make that change fast enough?”

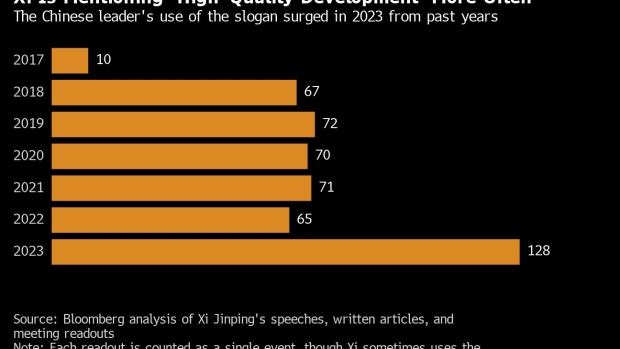

Part of the discontent stems from Xi’s failure to communicate a clear roadmap for reaching his goals. While the Chinese leader has ramped up mentions of “high-quality development” that fuzzy slogan is short on specifics. Economists have taken the phrase to mean putting sustainable growth over chasing the pace of expansion, with an emphasis on boosting innovative technologies.

New growth drivers such as electric vehicles, batteries and renewable energy alone, however, are unlikely to fill the void left by property, which at its peak drove about a quarter of China’s GDP. While bolstering strategic sectors can help shield China from the fallout of its rivalry with the US, overcapacity in these areas also threatens to inflame already tense geopolitical relations.

Xi’s unexplained decision to delay the third plenum, where top officials meet every five years to map out the country’s long-term policy direction, has added to the opacity. That confab of the party’s Central Committee is now delayed by the most in over three decades, as the Chinese leader continues to disrupt norms.

Official rhetoric putting a positive spin on things hasn’t helped. An article in the Communist Party’s mouthpiece headlined “There is an atmosphere of optimism throughout the country” was ridiculed by Chinese social media users last month, as they sarcastically contrasted the People’s Daily piece with their own finances.

“Everyone in society, and in government, seems to know there’s a problem,” said Neil Thomas, a fellow on Chinese politics at the Asia Society Policy Institute’s Center for China Analysis. “But there’s not been any decisions made about new approaches to solving those problems.”

The economic dissatisfaction comes after Xi’s strict Covid Zero policy undermined investor confidence in China, and sparked an exodus of foreigners and citizens. That misstep was emblematic of the “information cocoon” the president is operating in, said Yun Sun, director of the China program at Washington-based think tank Stimson Center.

“People cater to Xi’s preference for information and policies, which make objective assessment really difficult,” she said. While his abrupt decision to reverse course after rare nationwide protests against Covid lockdowns showed China’s top leader can pivot, “sudden policy turns usually carry a significant cost,” Sun added. Chinese citizens have since become more active in protesting economic policies, although directly criticizing Xi remains rare. Nearly a quarter of demonstrations last year took aim at regional leaders in some 1,450 cases where a target was identified by China Dissent Monitor. A group of US-based researchers wrote in a recent report that fear of government repression discourages some 40% of Chinese citizens from participating in anti-regime protests.

“Citizens also understand the party controls government at all levels, so failure to solve localized problems can reflect on the larger system,” said Kevin Slaten, who leads the China Dissent Monitor project. “Local grievances can certainly morph into larger movements that take on new meaning.”

Grassroots officials have been left trying to contain the discontent. The principal of a school in southern China warned staff against criticizing Xi or the party before a month-long national break began in January, according to an employee, who asked not to be identified discussing sensitive topics. Even during the pandemic no such message had been handed down, the person added.

In a lengthy essay published in December, China’s security czar Chen Wenqing detailed the benefits of reviving a Mao-era style of grassroots governance to contain local unrest. As China witnesses a “large amount of social conflict and disputes that are difficult to discover, prevent and handle” it’s important to mobilize ordinary people to stabilize society, wrote the former spy chief.

In eastern Anhui province, that system — known as the “Fengqiao experience” — has seen one party chief instruct unhappy villagers to talk directly to him as unemployment grips the local population. After layoffs at a state-owned enterprise in China’s northeast Liaoning province, a committee was tasked with visiting affected families, ensuring handouts were made on time to minimize unrest.

As Xi’s corruption campaign rolls on after more than a decade of purges there’s a growing reticence to take chances among officials increasingly focused on security and studying Xi Jinping Thought. Bureaucrats “lying flat” is a problem even recognized by the top leader. At a key economic meeting in December, Xi criticized local officials for procrastinating or misinterpreting the party’s orders.

“Sometimes you have to give people the room to make mistakes. But right now that’s not there,” said Liqian Ren, director of Modern Alpha at WisdomTree Inc., a New York-based asset management firm. “That’s a problem for China. You need the local officials to be willing to try things.”

Xi’s overarching mission is to meld enhanced Communist Party control with an economic model that minimizes dangerous forces unleashed during the reform era, according to Joseph Torigian, a research fellow at the Hoover History Lab in Stanford University.

“Xi isn’t giving up on the economy,” he said, but the Chinese leader wants people to accept that some suffering is needed as he pursues the nation’s bigger goals. “Whether the Chinese people are ready to go on that merry-go-round or not, I guess we’ll see.”

--With assistance from Philip Heijmans and Ben Westcott.

©2024 Bloomberg L.P.