May 1, 2023

Yellen Warns Congress Treasury May Run Out of Cash Soon as June

, Bloomberg News

(Bloomberg) -- Treasury Secretary Janet Yellen told US lawmakers that her department’s ability to use special accounting maneuvers to stay within the federal debt limit could be exhausted as soon as the start of June.

“Our best estimate is that we will be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1,” Yellen said in a letter to Speaker Kevin McCarthy and other congressional leaders from both parties. Given that revenue and spending flows are variable, “the actual date that Treasury exhausts extraordinary measures could be a number of weeks later than these estimates,” she wrote.

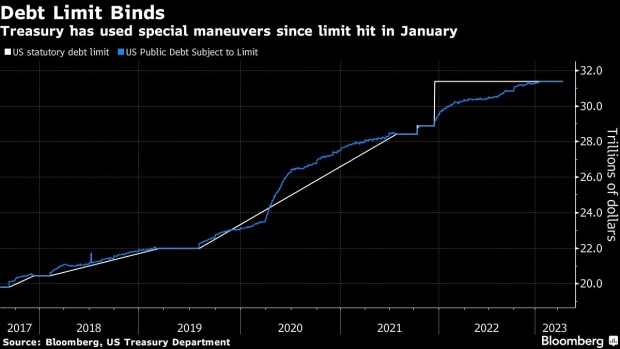

Since hitting the current statutory limit of $31.4 trillion in January, the Treasury has been staving off a possible default on federal obligations by using special accounting maneuvers. Yellen’s new timeline reflects the department’s latest thinking on when that headroom is likely to be exhausted.

President Joe Biden Monday afternoon called McCarthy to invite him to the White House on May 9 to discuss the debt limit, along with the other three bipartisan leaders of the two congressional chambers.

The Treasury’s timeline was reinforced Monday by the nonpartisan Congressional Budget Office, which warned separately that, based on its own estimates, there’s now a greater risk that the Treasury will run out of funds “in early June.”

“Given the current projections, it is imperative that Congress act as soon as possible to increase or suspend the debt limit in a way that provides longer-term certainty that the government will continue to make its payments,” Yellen said in her letter Monday.

Parts of the fixed-income market have shown increasing signs of concern about the risk of a US payments default. Yellen’s fresh timeline now offers investors even more of a focal point — which in turn may step up pressure on lawmakers to find some solution.

Lawmaker Reaction

The Treasury market yield curve continued on Monday to show dislocations around various points of concern, including June and August, although they were largely where they were prior to Monday’s announcement.

There’s no sign for now of any compromise in the offing in the partisan showdown over the debt limit, with lawmakers from both sides reinforcing their talking points Monday afternoon.

McCarthy on April 26 muscled a Republican bill that tied an increase to sweeping spending cuts through the House. But it cannot pass in the Democratic-controlled Senate. Biden is calling for a straightforward bill, such as Congress approved multiple times for former President Donald Trump.

GOP Senator John Cornyn said Monday that a clean debt limit bill can’t pass in his chamber, with the House taking the lead. And Democratic Senator Jon Tester said that he supports talks “on the debt but not the debt ceiling.”

The quick timeframe increases the likelihood Congress could explore a short-term debt limit increase into the fall, to line the battle up with the deadline to fund the government for fiscal 2024.

Biden has said he’s willing to discuss measures to reduce the fiscal deficit, but that ought to be addressed separately from the debt-limit legislation. But he may come under pressure to adjust his stance.

If the Treasury runs out of borrowing authority with Congress having failed to act, it would take the economy and markets into uncharted territory. A 2011 debt-limit showdown saw major damage to US consumer confidence and a sharp selloff in equities, even though lawmakers were able to act in time.

Yellen has warned that a default would produce “economic and financial collapse,” and that a non-payment of obligations would “undoubtedly” trigger a recession and undermine the dollar’s position as the world’s reserve currency — as foreign governments lose confidence in the country’s ability to pay its bills.

“We have learned from past debt-limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States,” Yellen said Monday.

Some House Republicans, as well as analysts, have floated the idea that the Treasury Department could, if necessary, prioritize payments on US Treasuries if it comes very close to running out of cash. But Yellen has repeatedly pushed back against that suggestion, saying that such prioritization would be a default by another name.

--With assistance from Benjamin Purvis, Alexandra Harris, Erik Wasson and Steven T. Dennis.

(Updates with Biden invitation to meet with congressional leaders in fourth paragraph and senators’ reaction in fourth paragraph after ‘Lawmaker Reaction’ subheadline.)

©2023 Bloomberg L.P.