Dec 20, 2022

Yen Has Scope to Keep Surging as BOJ Spurs Hedging, SocGen Says

, Bloomberg News

(Bloomberg) -- The Bank of Japan’s sudden policy adjustment is ramping up pressure on the country’s international investors to hedge their foreign assets, a move that could send the yen even higher, according to Societe Generale SA.

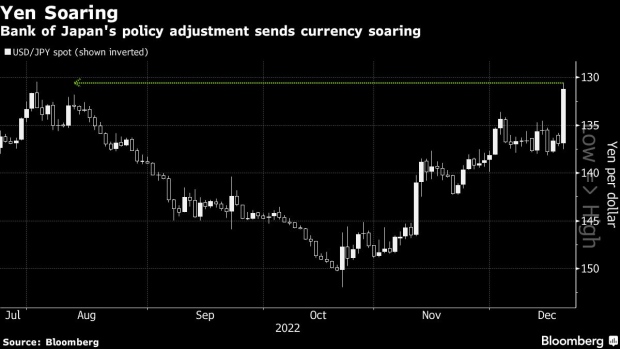

The currency — which at one point on Tuesday soared close to 5% and hit a level of 130.58 against the greenback and notched its biggest one-day advance this century — could strengthen to 125 per dollar in January as Japanese money managers adapt to the central bank’s more hawkish stance, said Kit Juckes, SocGen’s chief foreign-exchange strategist.

The yen ended the session around 131.73 per dollar, 3.9% stronger than it was around 24 hours prior. That was the biggest full day gain for the currency since 1998.

Read: Kuroda Shocker Is Just the Start of BOJ’s Risky Path Toward Exit

“We’ve previously argued that big USD/JPY swings are largely a function of Japan’s net international investment position, and changes in FX hedging ratios,” he wrote. “This move increases pressure to hedge foreign asset portfolios and so, to buy the yen, in thin holiday markets.”

The yen led gains among its Group-of-10 currency peers Tuesday after BOJ Governor Haruhiko Kuroda shocked markets by doubling a cap on 10-year yields, sending waves across the global financial markets. Yields rose on Japanese and US government debt, while US shares swung between gains and losses.

(Updates pricing.)

©2022 Bloomberg L.P.