Apr 25, 2023

Yen Traders Need to Be Wary of One-Way Bullish Bets, RBC Says

, Bloomberg News

(Bloomberg) -- Yen watchers may be overestimating how positive the impact of any Bank of Japan policy changes on the currency will be, according to RBC Capital Markets.

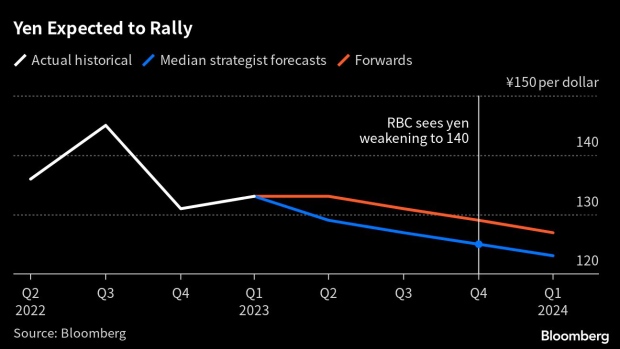

The vast majority of forecasts on Bloomberg have the Japanese currency strengthening to levels beyond that implied by the forward market, noted strategist Adam Cole in a note Tuesday. That suggests analysts are almost all one way on the direction of the dollar-yen — lower — he said.

The median dollar-yen forecast for the end of this year was 125 on Wednesday, compared to a forward rate of 129, according to data compiled by Bloomberg. The pair traded around the 133.70 level in early Asia trading.

“Risk in FX markets is rarely as asymmetric as this implies,” Cole wrote. RBC has a year-end target of 140 yen per dollar, wagering the impact of higher interest rates globally will outweigh any reaction to the potential end of yield-curve control, according to the note.

Plans by Japan’s life insurers to reduce their holdings of currency-hedged foreign bonds will also weigh on the yen over time, he added.

Japan Insurer’s Plan to Sell Foreign Debt Flashes Market Warning

“In the longer-term, this will drive dollar-yen higher, though we don’t rule out shorter-term bouts of selling from outside Japan, particularly around BOJ policy announcements,” Cole said. “A deep US and global recession would upend our forecasts, but is not in our central forecast.”

©2023 Bloomberg L.P.