Aug 23, 2022

Young retail traders see 'even worse' times ahead for markets

, Bloomberg News

Two stocks to hedge against recession-based volatility: Kim Bolton

US institutional investors became more optimistic about stocks during the summer rally, but retail traders under 40 are becoming more gloomy over where markets are headed.

“I don’t think the storm will be over in this year or next year,” said Errol Coleman, a 23-year-old in Tampa, Florida, who creates educational content for social media platforms. “The rally that we’re seeing right now isn’t something to be too excited about.”

Millennial and Generation Z investors are now experiencing the highest inflation in their lifetimes, a hawkish Federal Reserve and their first non-pandemic-spurred bear market. This is crimping their trading activity and their outlook for stocks.

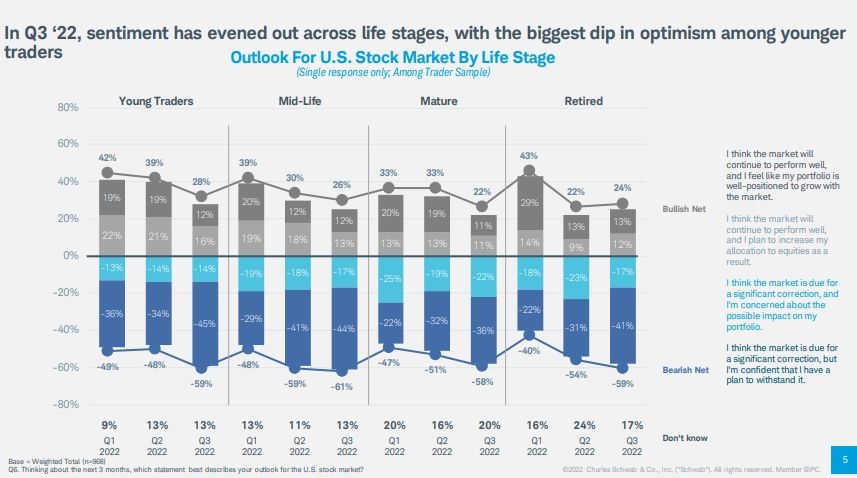

That’s borne out in recent surveys. Earlier this month, Charles Schwab & Co. found that 59 per cent of retail investors age 40 and younger said markets are “due for a significant correction,” up 10 percentage points from Schwab’s February poll.

“This is the first time young traders are navigating a bearish market and that’s why they’re taking a more conservative approach,” said Barry Metzger, head of trading and education at Charles Schwab.

Kyle Granger, a 24-year-old investor and waste-industry entrepreneur, says the market will see a second leg lower that might be “even worse” than the bottom it hit in June -- one that will “hit the entire economy.”

Do-it-yourself traders have been on a dramatic ride in the last few years. Thanks to COVID lockdowns and government assistance cash, retail traders’ share of US equity trading volumes climbed to 24 per cent in the first quarter of 2021, according to data by Bloomberg Intelligence. It fell back to 17 per cent in the second quarter of this year.

Young traders have continued to hunker down. A survey conducted by TD Ameritrade found most of their millennial clients reduced stock exposure in July and, unlike their overall client base, became net sellers of equities as economic conditions worsened.

And a return of the pandemic-era meme stock craze ended badly -- again. Bed Bath & Beyond Inc. shares, which jumped more than 400 per cent from mid-July on retail-trader enthusiasm, collapsed after top investor Ryan Cohen exited his stake. This also dragged down old day-trader favorites like GameStop Corp. and AMC Entertainment Holdings Inc.

Wary of the violent swings in equity markets and the potential for a prolonged slump, some young investors have altered their trading styles. Sebastian Tejero Gutierrez, an 18-year-old student in Bolivia, said the pandemic was a great time for retail traders, but he now thinks short-term positions are safer because of high inflation and economic uncertainty.

“It isn’t a great moment for long-term investments,” he said in a phone interview. “I’m afraid of a market crash and I don’t feel I’ll win keeping the stocks for more than a day.”

Joel Perez, 33, who runs construction and real estate businesses in New Jersey but made retail trading his main focus a little over a year ago, said traders have become more knowledgeable and can “play the game better” to make money no matter which way markets go.

“While many traders are willing to take the same amount of risk, the strategy has changed from holding stocks on expectations that they will go up to short-term trading,” said Perez, who thinks long-term investments lead to lower returns due to the market volatility.

Retail traders have also had to shift their attention from social media signals to economic indicators.

“The young trader does care about inflation but not because of consensus estimates, followed by most experts, but because it impacts specific stocks they play,” said Jaime Rogozinski, founder of the popular online stock-market chat forum WallStreetBets.

Still, whether this crop of investors alters styles or shifts indicators, investment professionals are encouraged that so many retail traders remain engaged with the markets.

“Once they learn how to invest and trade themselves, they will be investing more as they grow,” said Hady Farag, partner and associate director at Boston Consulting Group.