Dec 7, 2022

Experts react to Bank of Canada hiking rates for seventh straight time

, BNN Bloomberg

We still see Canadian interest rates at 6% by the end of 2023: Earl Davis

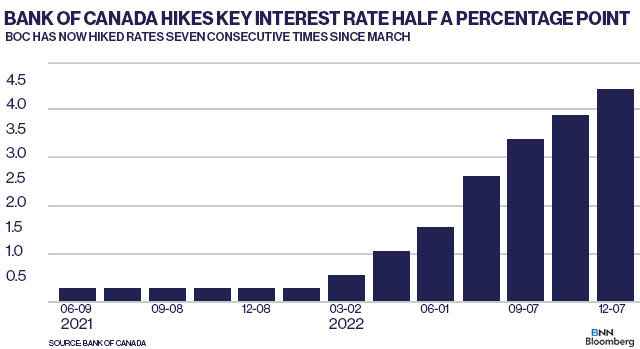

The Bank of Canada hiked its key policy rate by half a point to 4.25 per cent on Wednesday, marking a seventh consecutive increase.

Royce Mendes, managing director and head of macro strategy at Desjardins Capital Markets, said the 50-basis-point [bps] hike was surprising to them since the central bank “did acknowledge that domestic demand is slowing.”

“It's sort of surprising to us given that the Bank of Canada did acknowledge that domestic demand is slowing, measures of core inflation are falling and they still opted to do another 50-basis-point increase,” Mendes said in a phone interview on Wednesday.

Stephen Brown, senior Canada economist at Capital Economics, said the most important change out of this announcement was the central bank’s language about future rate hikes.

“I think it was almost a dovish 50 basis points [bps], but the key thing really is the change in forward guidance,” Brown said in a phone interview on Wednesday.

“The bank has been telling us for several meetings now that they expect the policy rate will need to rise further, whereas today they’ve changed that language to ‘considering.’”

In the Bank of Canada’s statement, it said the central bank would be considering whether the policy interest rate needs to be raised again.

“Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target,” the Canadian central bank said on Wednesday.

“Governing Council continues to assess how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

“We would not rule out a final 25 bps interest rate hike in January, but the bank is very close to the end of its tightening cycle,” Brown said.

Mendes added the recent string of interest rate hikes will be felt even more by Canadians over time.

“When they [higher interest rates] do begin to show up in a more pronounced way, the reaction to higher interest rates could be like an avalanche,” Mendes said.

“Things can take longer to happen than you expect, but when they do it’s very rapid. Just because you’re not seeing it just yet, that doesn’t mean they’re not going to have a very pronounced impact on the economy.”