Jan 18, 2019

A Bullish ETF Trader With $6 Billion Just Made Some Risky Bets

, Bloomberg News

(Bloomberg) -- One big investor flipped the risk-on switch this week, trading about $6 billion worth of exchange-traded funds as global markets flashed bullish signals following a brutal December.

On Wednesday, a frenzy of fresh trading hit U.S-listed products, and was likely the work of a single manager, according to Josh Lukeman, head of ETF market making for the Americas at Credit Suisse Group AG. Among the moves: yanking cash from investment grade bonds and splashing it into high yield, and swapping out developed-market equities for EM.

The shift comes as a dovish Federal Reserve, steady economic growth and optimism over trade renew investor appetite for risk, with U.S. high-yield funds taking in monster inflows while stocks and oil get off to roaring starts this year.

“It looks like the same money manager made some big portfolio changes,” said Mohit Bajaj, director of exchange-traded funds at WallachBeth Capital. “No one wants to sit on the sidelines if this run continues to happen.”

The $31 billion iShares iBoxx Investment Grade Corporate Bond ETF, or LQD, suffered an outflow of over $907 million, its biggest since February 2018, according to data compiled by Bloomberg. The bulk of Wednesday’s outflows likely came from this trader, who sold close to 5 million shares worth $568 million at 2:06 p.m. in New York on Wednesday.

A couple of hours earlier, the same investor likely bought a block of the $2 billion XTrackers USD High Yield Corporate Bond ETF, or HYLB. A trade of 4.7 million shares worth $229 million hit the tape at 12:11 p.m.

A swift uptick in U.S. junk bond prices is convincing strategists to significantly upgrade their annual forecasts. Goldman Sachs Group Inc. strategists expect junk offerings to remain subdued this year -- helping boost prices -- but say it’s a different picture for investment grade, with issuance already tracking 10 percent above last year’s level.

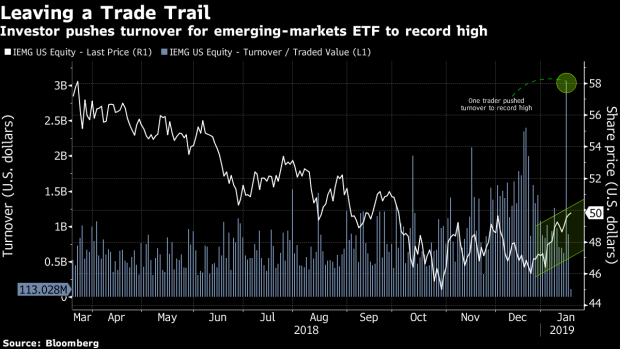

Developing-market assets were also on the menu for the money manager, who bought just over $1 billion of the iShares Core MSCI Emerging Markets ETF, or IEMG, pushing Wednesday’s turnover for the fund to a record high. At the same time, they dumped $876 million of the iShares Core MSCI EAFE ETF, ticker IEFA, which tracks developed market stocks.

The buyer also allocated to the iShares MBS ETF of mortgage-backed securities, as well as value and growth funds from Vanguard. All in, the investor traded over $6 billion worth of funds.

Developing-market assets are also off to a running start this year as monetary and trade worries ease -- even as strategists warn that EM bulls risk getting caught in a stampede.

--With assistance from Tom Lagerman (Bloomberg Global Data).

To contact the reporter on this story: Carolina Wilson in New York City at cwilson166@bloomberg.net

To contact the editors responsible for this story: Samuel Potter at spotter33@bloomberg.net, Yakob Peterseil, Sid Verma

©2019 Bloomberg L.P.