Nov 25, 2022

A Week to Remember for Manchester United Investors as Stock Surges 68%

, Bloomberg News

(Bloomberg) -- Manchester United Plc investors have had themselves a week to remember.

From the departure of renowned star Cristiano Ronaldo to news of a possible sale of one of the world’s biggest soccer clubs, shares of the US-listed English sports company have gone on a wild ride. The stock has surged 62% to add about $1.3 billion in market value and trade at its highest level since February 2019.

After soaring by a record on both Tuesday and Wednesday, Manchester United shares jumped for a third straight day Friday as Saudi Arabia’s sports minister Prince Abdulaziz bin Turki Al-Faisal told BBC Sport that its government would back private sector bids for the team.

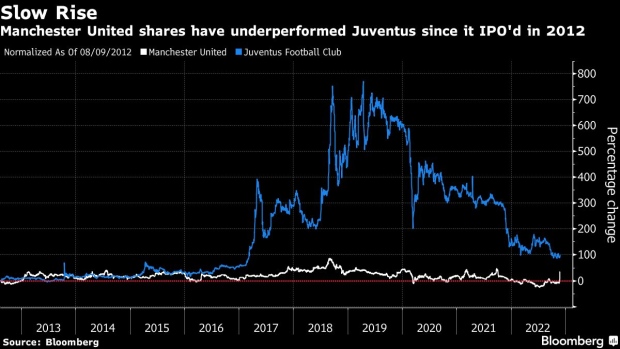

While the record week of trading has been a welcomed boost for investors, it comes after years of languishing. Entering this week, Manchester United shares had overall been an unprofitable trade, saddling investors who had bought in at the club’s $14 initial-public-offering price in August 2012 with roughly a 6% loss.

That’s far worse than the gains seen by shareholders of fellow European giant Juventus Football Club SpA, which returned investors more than 90% over that same stretch on the Italian bourse. Even after this week’s surge, Manchester United is only up about 52% since its IPO, trailing equity benchmark’s in both the US and Europe.

This week’s swift rise for Manchester United’s shares has also helped its market capitalization balloon back above the $3 billion mark, a level that it has traded above only a handful of times over the last three years. While investors may be cheering the rapid climb, not everyone is buying in. Jim O’Neill, a former Goldman Sachs Group Inc. economist who led a bid for the club in 2010, said in a Bloomberg TV interview that whatever the current valuation is right now, “it’s too much.”

Bloomberg News reported in August that the Glazer family would consider selling a minority stake in Manchester United in a deal that could value the team at about £5 billion ($6 billion).

(Updates with closing prices throughout.)

©2022 Bloomberg L.P.