Jul 20, 2022

Alcoa Jumps After Quarterly Profit, Sales Top Analyst Estimates

, Bloomberg News

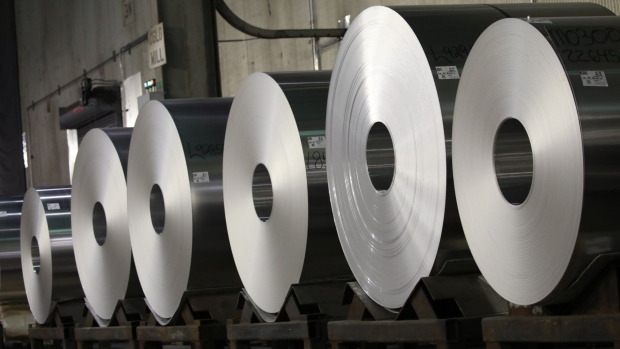

(Bloomberg) -- Alcoa Corp. reported better-than-anticipated earnings that highlighted how the top US aluminum producer is weathering a recent downturn in sentiment for the lightweight industrial metal.

The Pittsburgh-based producer posted $913 million in adjusted earnings before interest, taxes, depreciation and amortization in the second quarter, beating the $908.7 million average estimate of nine analysts compiled by Bloomberg. The company also announced a $500 million share buyback.

Aluminum prices are down about 15% this year as concerns about demand prospects mount due to Covid-19 lockdowns in China, the world’s biggest producer, along with surging power costs in Europe and rising inflation around the world. Alcoa shares have been volatile this year, surging in February and March as consumers effectively cut out supply from Russia, before dropping on concerns of a global economic slowdown.

The earnings statement was released after the close of regular trading in New York, where Alcoa surged as much as 6% as of 4:12 p.m.

©2022 Bloomberg L.P.