May 31, 2022

Alternative income strategies may be one of the best ways to navigate the current market

- As we emerge from the pandemic and transition to a higher interest rate environment, investors need to be more selective about their portfolio positioning

- Equity income presents numerous solutions that are well-suited to generate yield in this unfamiliar investment landscape

- With Global X ETF’s Equity Income Whitepaper, investors learn how to take a holistic approach for higher yields in this challenging environment

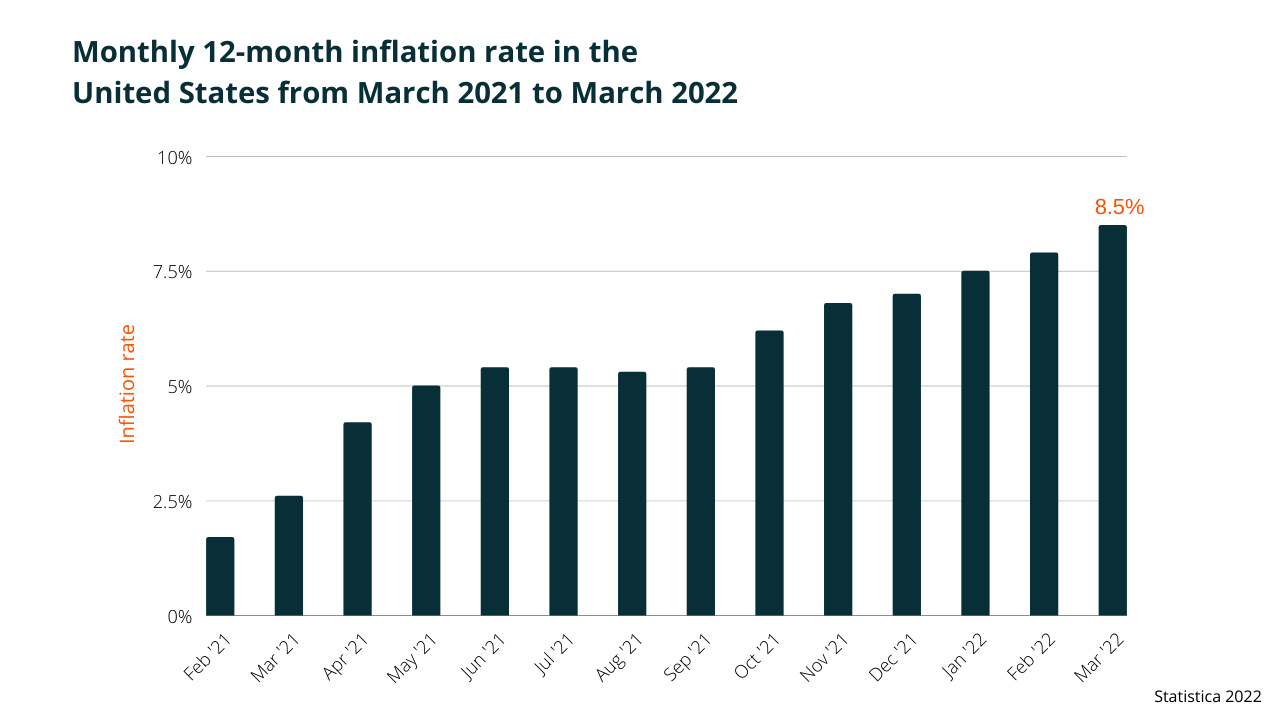

Investors looking at the economic picture might think they're watching an episode of That ‘70s Show as interest rates rise and oil prices soar. But there's nothing funny about this double-dose of déjà vu that's taking a lot out of paycheques and putting pressure on portfolios. It's a picture that we haven't seen in decades.

Plotting a path through this unfamiliar investment landscape poses major challenges. Inflationary pressure and skyrocketing fuel prices coupled with the war in Ukraine have caused the International Monetary Fund to revise its forecast for global economic growth for 2022 downwards to 3.6 per cent from 6.1 per cent. Rising interest rates, higher inflation and a slowing economy may force investors to be more selective in portfolio positioning.

Investors face both old and new challenges in seeking income

Even before the pandemic and current geopolitical issues, investors have long had challenges in constructing income portfolios. On one hand, increased longevity requires assets to generate both income and growth. On the other hand, simple diversification between traditional fixed income and equities (such as a 60/40 portfolio) may not be effective under various economic scenarios.

"The question is, can you actually receive enough income to last for your entire lifetime? People are spending more time in retirement, which means they need a very robust income stream for a longer time in their life. What they need are alternative income sources" – Warner Wen, Director of Canadian Institutional Coverage, Global X ETFs

"If you're an investor looking for high yield, how do you do that?" asks Global X's Director of Canadian Institutional Coverage, Warner Wen.

"How do you survive in a market where neither equity nor bonds are doing well? That's the key problem and the key question we're trying to help people solve."

With people living longer, retirees may need to depend on their savings for more than 20 years. This increases longevity risk – the chance that seniors outlive their savings. To mitigate this, investors will increasingly look to put investments with both income and growth characteristics in their retirement portfolios.

"The question is, can you actually receive enough income to last for your entire lifetime? People are spending more time in retirement, which means they need a very robust income stream for a longer time in their life. What they need are alternative income sources," explains Wen.

Global X recommends building a broader basket of investment options to create a sustainable income stream

In its Equity Income whitepaper, Global X discusses how alternative income solutions can help increase a portfolio’s yield, diversify exposures, and in many cases also offer growth potential. These alternative sources of income may be especially relevant in the current environment which makes it difficult to obtain yield from traditional sources such as Treasuries and corporate bonds.

One of those alternatives is Master Limited Partnerships (MLPs), which are publicly traded entities that own and operate key pieces of infrastructure involved in the transportation, storage, and processing of resources like crude oil and natural gas. Because of their nature of business, MLPs tend to benefit from higher energy prices.

"It's one of the highest yielding asset classes right now because of the boom in the energy sector," says Wen.

"In the U.S., the structure of the MLP actually requires it to distribute 90 per cent of its income in the form of dividends to investors, so it's a very attractive asset class to be looking at right now."

Wen also notes historically, the correlations between MLPs and other broad asset classes, such as U.S. equities and corporate bonds, are fairly low. This makes MLPs a strong portfolio diversifier in an investor’s total portfolio.

Covered call and collar strategies take advantage of volatility, making it work for the investor

Another alternative income solution is the covered call strategy where an investor owns an underlying asset, like a stock or basket of stocks, and sells a call option on the asset to generate income via the premium received for writing the option. While the upside potential is capped in case the stock appreciates beyond a pre-determined threshold (known as the strike price), option premiums tend to increase during volatile markets, offering a risk management component.

"With a covered call strategy, you earn a monthly premium. When volatility rises, the premium received rises, which is a way of translating potential market volatility into an income stream," says Wen.

For investors looking for more downside protection amid market volatilities, a collar strategy can be appropriate. Like a covered call strategy, call options are sold on an index like the S&P 500 or Nasdaq. But with a collar, put options are also purchased on the index, which limits the losses in case the index drops below a pre-determined strike price. The end result is a lower yield relative to the covered call on its own. However, the downside protection might be preferred by certain investors.

"The risk/reward trade-off in a collar strategy as compared to a covered call, is about giving up a little bit of yield in exchange for a known downside protection,” says Wen.

Quality dividends are important to watch in common equity yield opportunities

"Generally speaking, dividend strategies largely fall into one of three categories: high dividend, dividend growth, and quality dividend – each with their own characteristics and objectives," says Wen.

“Quality dividends are defensive-oriented. They are paid by companies that tend to have better balance sheets and financial health, which means they are likely to maintain their dividend payments across a variety of economic climates.”

"How do you define that? You look at free cash flow, how consistent they're paying the dividends and where these dividends are coming from. I think that’s very relevant in today's environment."

As explained in Global X’s whitepaper, quality dividends typically produce a lower yield than traditional high dividend strategies, but it is less sensitive to economic cycles. Investors can view this segment as a core strategic holding given its focus on profitable growth and quality value.

Global X encourages investors to take a holistic approach for higher yields

Global X's Equity Income whitepaper is a resource that investors can use to identify options to broaden their range and type of investments in volatile times. With the current macroeconomic and market conditions for equities and traditional fixed income, it is essential to take a holistic approach that considers the sustainability of the yield and the investment from a total return perspective.

"For over a decade, we were in a super low-yield, low-interest rate environment and now people are being forced to adapt quickly to this very different rate and economic regime. We're here to help investors meet these challenges," says Wen.

To learn more about Global X ETFs, visit their website here.

Check out the Equity Income whitepaper here.

For more news on the investing landscape, follow Global X on social media: