Aug 9, 2021

AMC beats analysts' estimates despite soft movie attendance

, Bloomberg News

McCreath: Safer bet to gamble in Las Vegas than invest in meme stocks

AMC Entertainment Holdings Inc., the world’s largest theater chain, posted a narrower quarterly loss, beating analysts’ estimates with results that nonetheless underscore the movie industry’s struggle to draw fans back to cinemas and compete with streaming options at home.

With theaters back open, the second-quarter loss shrank to 71 cents a share excluding items, AMC said Monday, better than the 94-cent loss analysts were predicting. Revenue soared to US$444.7 million, from virtually nil a year ago, and was better than the US$382.3 million that Wall Street had expected.

Key Insights

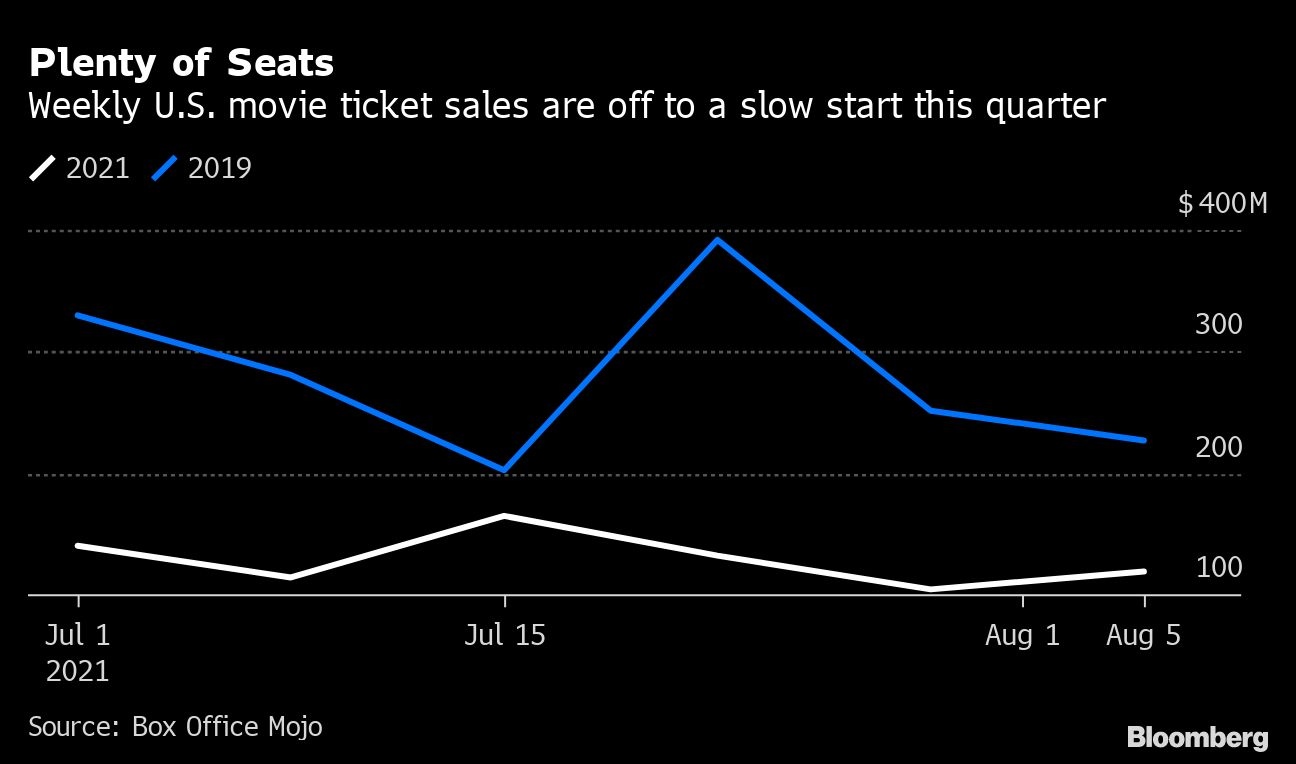

- With second-quarter revenue less than a third of the summer-season peak of US$1.51 billion two years ago, AMC needs more fans in seats to cut its losses. One of the biggest movies of the year, “The Suicide Squad,” opened to North American sales of about US$27 million last weekend, a fraction of what major films normally do.

- AMC said on Monday that customers are returning after the entire industry shut down in 2020, when the coronavirus was raging across the world. Attendance totaled 22.1 million at its theaters globally in the period. But many of this year’s biggest movies are also being offered online on the same day that they open in theaters.

- While struggling to stay solvent, AMC became a popular “meme” stock this year, soaring from under US$10 to more than US$72 at one point. That allowed management to raise cash, refinance and stave off bankruptcy. But borrowings have stayed high at more than US$10.4 billion in long-term debt and leases. The company has more than US$2 billion in cash and unused revolving lines of credit.

- Adam Aron, chief executive officer, sees small investors, who now make up the majority of AMC shareholders, as key to his success. He’s offered them special access to new movies, free popcorn and coffee, and in an unconventional move will take questions directly from them later Monday.

Market Reaction

- The shares rose as much as 5.1 per cent to US$35.50 in after-hours trading. The stock has jumped 15-fold this year, mostly as a result of a frenzy of internet traders.