Jan 27, 2023

AMLO Says Plan Coming for Pemex’s Debt, Including Possible Transfer

, Bloomberg News

(Bloomberg) -- Mexico is developing a plan to help Petroleos Mexicanos pay off some of its $105 billion in debt through measures such as tax reduction or a transfer to the government, sparking a rise in the oil company’s bonds.

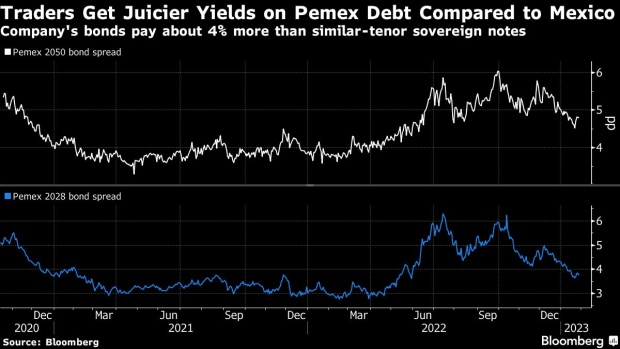

The Finance Ministry could cut taxes or transfer Pemex debt to sovereign debt, said Andres Manuel Lopez Obrador, known as AMLO, during his morning press conference on Friday. “It has been done since the first year, and we are going to continue doing it, and other actions, helping with the transfer of Pemex debts to sovereign debt, to treasury debt,” he noted. “It is also an important practice because the credit rates are lower for sovereign debt than Pemex debt or debt from the Comision Federal de Electricidad,” the national power company.

The aid would be a boon for Pemex, which has the highest debt of any oil company in the world. Yet the risk is that it could negatively affect already-strained public coffers. Lopez Obrador noted that lawmakers have already approved a debt limit for the government that it cannot go beyond.

“For years the Mexican government has been coy about support for Pemex, having them issue bonds to repay maturing debt, as if market discipline would keep the company in check, but it hasn’t worked,” said Roger Horn, a senior strategist at SMBC Nikko Securities America in New York. “AMLO coming out and saying that some debt could be transferred the government is the most explicit anyone has been.”

Pemex bonds whipsawed this week. The company’s dollar bonds due 2050 were the best performers in the high-yield bond market Friday, up as much as 3 cents on the dollar to 77 cents, according to Trace data. The notes sold off earlier this week when Bloomberg reported Pemex’ plans to sell new debt.

The government has spent more than $20 billion in capital injections and tax cuts for Pemex since AMLO swept into power in late 2018. Pemex’s profit-sharing duty has been slashed several times to reach 40% in 2022, from 65% in 2019.

Yet it hasn’t been enough to move the needle. The state oil company is facing a liquidity crunch, with payments piling up after nearly two decades of declining oil production. Revenues have also suffered as the firm focuses on refining — reducing sales from oil exports — and the company has failed to invest significantly in new fields to replenish its dwindling reserves.

Pemex’s debt has been slashed to junk by international credit rating companies including Moody’s Investor Service and Fitch Rating.

Pemex Plans Bond Sale in Weeks With Billions in Payments Due (2)

One concern is how the government will help Pemex while maintaining its policy of fiscal austerity. Public coffers are constrained due to massive, over-budget government infrastructure projects such as the Train Maya and the Dos Bocas, or Olmeca, refinery — which has yet to produce gasoline.

Fitch Ratings managing director Shelly Shetty said at an event in Mexico City on Thursday that Pemex’s debt was about 7% to 8% of gross domestic product. Mexico has kept its debt level below 50% of GDP, which has helped support the peso, she said.

Lopez Obrador said that the Finance Ministry will announce as soon as today at least a timeline for when details of the plan will be revealed. Bloomberg reported that Pemex could issue as much as $2 billion in bonds to help pay off amortizations that account for about $10 billion this year.

“The president’s comments come as the company is preparing for a market transaction, which may be perceived as opportunistic to lower borrowing costs,” said Aaron Gifford, an emerging-market sovereign-debt analyst at T. Rowe Price Group in Baltimore. “However, his speeches usually reflect his conviction, which means the market should expect more government support than previously anticipated.”

--With assistance from Carolina Gonzalez, Maria Elena Vizcaino and Michael O'Boyle.

(Updates throughout with analyst comments and context on government support for Pemex.)

©2023 Bloomberg L.P.