Apr 10, 2023

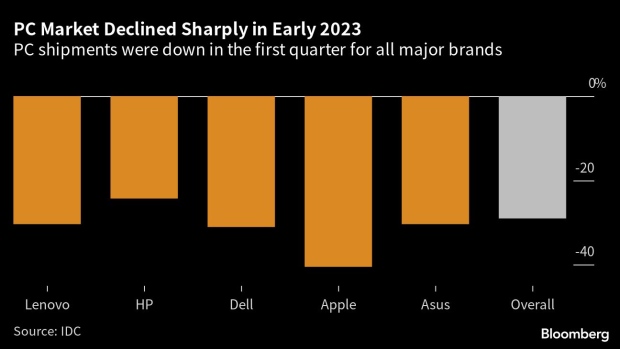

Apple’s 40% Plunge in PC Shipments Is Steepest Among Major Computer Makers

, Bloomberg News

(Bloomberg) -- Apple Inc.’s personal computer shipments declined by 40.5% in the first quarter, the worst drop since the final three months of 2000, after sluggish demand and an industrywide glut hit the Mac maker especially hard.

Shipments by all PC makers combined slumped 29% to 56.9 million units — and fell below the levels of early 2019 — as the demand surge driven by pandemic-era remote work evaporated, according to IDC’s latest report. Among the market leaders, Lenovo Group Ltd. and Dell Technologies Inc. registered drops of more than 30%, while HP Inc. was down 24.2%. No major brand was spared from the slowdown, with Asustek Computer Inc. rounding out the top 5 with a 30.3% fall.

The report is a particular blow to Apple, whose shipments had largely held up since the onset of the pandemic. The company had nevertheless been preparing investors for weaker results in some of its hardware, with a rocky economic backdrop threatening to dampen enthusiasm for Apple’s products.

PC market declines have been seen for multiple quarters, and a rebound in the second half of the year is still possible, said Anurag Rana, a Bloomberg Intelligence analyst. Apple was especially hurt by higher exposure to the consumer market and tougher comparisons to a strong period the year prior, he added.

When Apple last suffered such a steep drop in Mac demand, the tech industry was grappling with the dot-com bust. Steve Jobs had only been back as chief executive officer for a few years, and the company recently rolled out an unsuccessful computer known as the Cube.

As it copes with the latest downturn, Apple is readying new models that could help spur demand. The company is gearing up to launch its next slate of laptops and desktops later this year, Bloomberg reported, including a new iMac.

During a February earnings call, Chief Financial Officer Luca Maestri said the company expects Mac revenue to decline by a percentage in the double digits in the quarter ending in March. During the same call, CEO Tim Cook said that a successful computer product launch the previous year means that current MacBook sales figures face tough comparisons, and the company continues to face a “challenging” economic environment.

The slowdown in consumer spending over the past year has led to double-digit declines in smartphone shipments and an accumulating glut among the world’s foremost memory chip suppliers. Samsung Electronics Co., which provides memory for portable devices as well as desktop and laptop PCs, last week said it’s cutting memory production after reporting its slimmest profit since the 2009 financial crisis.

Apple shares fell 1.9% at 2:39 p.m. in New York. Dell shares rose 2.2%, while HP gained 1%.

A silver lining is that the cooling demand is giving manufacturers the time and room “to make changes as many factories begin to explore production options outside China,” IDC said in the report. Apple is gradually diversifying the geography of its manufacturing base as brewing tensions between Washington and Beijing threaten to disrupt its carefully orchestrated supply chain.

Read more: Apple Looks Beyond China in Bid to Remake Cook’s Supply Chains

Looking toward 2024, the IDC researchers foresee a potential rebound for PC makers, driven by a combination of aging hardware that will need to be replaced and an improving global economy.

--With assistance from Gao Yuan and Brody Ford.

©2023 Bloomberg L.P.